Best CRM for investment bankers: Securing lucrative deals and fostering strong client relationships in the high-stakes world of investment banking requires a robust and efficient CRM system. This guide delves into the crucial features, integration capabilities, and deployment models that distinguish the best CRMs for this demanding sector, ultimately helping firms streamline operations and achieve greater success.

From contact management tailored to deal tracking to sophisticated reporting and analytics dashboards, we explore the essential functionalities that empower investment banking professionals. We also examine the critical aspects of seamless integration with existing tools and the implications of choosing between cloud-based and on-premise CRM solutions. Through insightful case studies and a look at future trends, including the impact of AI and machine learning, this comprehensive guide provides a roadmap to selecting and implementing the optimal CRM strategy for investment banks.

Defining Investment Banking CRM Needs

Investment banking operates at a frenetic pace, demanding a CRM system far beyond the capabilities of standard contact management software. The need extends to sophisticated tools that streamline deal flow, manage complex relationships, and ensure compliance with stringent regulatory requirements. A robust CRM is not merely a luxury but a critical component of operational efficiency and competitive advantage in this high-stakes industry.Investment banking professionals require a CRM that supports their unique workflow and data management challenges.

The system must be flexible enough to adapt to the ever-changing landscape of financial markets and capable of providing real-time insights to support strategic decision-making. The ability to effectively track interactions, manage deal pipelines, and analyze performance data is crucial for success.

Core CRM Functionalities for Investment Bankers

Investment banking CRMs must go beyond basic contact management. They need to offer advanced features designed to handle the intricacies of deal-making and client relationships. Key functionalities include comprehensive contact management with detailed relationship histories, robust deal tracking capabilities with customizable stages and milestones, advanced reporting and analytics to monitor performance and identify trends, seamless integration with other financial systems (such as deal flow management software and financial modeling tools), and secure communication tools to facilitate collaboration among team members and clients.

The ability to personalize client interactions and maintain a comprehensive audit trail is also essential.

Data Management Challenges in Investment Banking

Investment bankers handle vast amounts of sensitive data, including client financial information, deal specifics, and market intelligence. Managing this data effectively and securely presents significant challenges. Data silos, inconsistent data formats, and difficulty in accessing real-time information can hinder decision-making and lead to missed opportunities. The sheer volume and complexity of data require a CRM with robust data management capabilities, including data cleansing and standardization tools, advanced search and filtering options, and the ability to integrate with data analytics platforms for comprehensive insights.

Furthermore, the ability to manage multiple data sources and ensure data consistency across the organization is paramount. For example, integrating data from multiple deal databases, investor profiles, and internal communications systems is crucial for a holistic view of client relationships and deal progress.

Security and Compliance in Investment Banking CRMs

Given the sensitive nature of the data handled by investment bankers, security and compliance are paramount. A robust CRM must adhere to strict industry regulations, such as GDPR, CCPA, and FINRA rules. This necessitates features such as role-based access control, data encryption both in transit and at rest, comprehensive audit trails to track all data access and modifications, and regular security assessments to identify and mitigate potential vulnerabilities.

The CRM should also facilitate compliance reporting and provide tools to ensure data integrity and accuracy. Failure to comply with these regulations can result in significant financial penalties and reputational damage, making robust security and compliance features a non-negotiable requirement for any investment banking CRM. For instance, granular permission settings would ensure only authorized personnel can access sensitive client information, while automated data backups would safeguard against data loss in case of a system failure.

Top CRM Features for Investment Bankers: Best Crm For Investment Bankers

Investment banking thrives on relationships and deal flow. A robust CRM system is crucial for managing both efficiently, improving team productivity, and ultimately boosting profitability. The right CRM offers functionalities far beyond basic contact storage; it empowers deal tracking, enhances pipeline visibility, and provides insightful analytics crucial for strategic decision-making.

Contact Management for Deal Tracking

Effective contact management is the cornerstone of successful deal tracking in investment banking. A CRM system allows bankers to centralize all client interactions – emails, calls, meetings, and documents – in one easily accessible location. This eliminates the risk of lost information and ensures everyone on the team is on the same page regarding client communication history and deal progress.

Furthermore, features like automated reminders for follow-ups and task assignments streamline workflows, preventing crucial deadlines from being missed. This enhanced organization minimizes errors, prevents dropped deals, and accelerates deal closure. For example, tracking all communications with a potential acquirer for a client’s company allows for precise reporting on the progress of negotiations, including identifying potential roadblocks and proactively addressing them.

Pipeline Management for Improved Deal Closing Rates

Pipeline management tools within a CRM provide a visual representation of the deal flow, allowing bankers to monitor the progress of each deal through its various stages. This real-time visibility empowers proactive management, enabling identification of potential bottlenecks and facilitating timely interventions. Features such as probability scoring, forecasting, and automated alerts for stalled deals help in prioritizing efforts and optimizing resource allocation.

For instance, a visual pipeline showing a deal stuck in due diligence could prompt immediate action from the team, preventing deal delays or even loss. By strategically managing the pipeline, investment banks can significantly increase their deal closing rates.

Reporting and Analytics Dashboards for Investment Banking

Customizable reporting and analytics dashboards are essential for gaining valuable insights into the performance of the investment banking team and individual bankers. Dashboards should be tailored to display key metrics relevant to investment banking, such as deal closure rates, average deal size, revenue generated per banker, and win/loss ratios. This data allows for performance monitoring, identification of areas for improvement, and informed strategic planning.

For example, a dashboard displaying a low win rate for a particular deal type could indicate a need for refining the team’s approach to that specific market segment. Real-time data visualization empowers proactive decision-making and enhances overall operational efficiency.

CRM System Feature Comparison

| CRM Name | Deal Tracking | Reporting & Analytics | Integration Capabilities |

|---|---|---|---|

| Salesforce Financial Services Cloud | Robust contact and opportunity management, customisable stages and workflows | Comprehensive dashboards and reports, customizable reporting tools | Integrates with various financial data platforms and other business applications |

| Microsoft Dynamics 365 | Strong deal tracking capabilities, pipeline visualization, forecasting | Customizable dashboards and reports, robust analytics features | Seamless integration with other Microsoft products and third-party applications |

| Zoho CRM | Contact management, deal tracking with customizable stages, pipeline management | Customizable reports and dashboards, basic analytics | Integrates with various third-party applications via APIs |

| HubSpot CRM | Contact management, deal tracking, pipeline visualization | Reporting and analytics tools, customizable dashboards | Integrates with various marketing and sales tools |

CRM Integration with Existing Investment Banking Tools

Seamless integration is paramount for a CRM system within an investment bank. The goal is not just to add another software; it’s to create a unified platform that streamlines workflows and improves overall efficiency. A successful integration minimizes data entry duplication, reduces the risk of errors, and allows for a more holistic view of client interactions and deal progress.Effective integration with existing tools significantly reduces the time investment bankers spend on administrative tasks, allowing them to focus on relationship building and deal execution.

This translates directly to increased productivity and improved bottom-line results. For instance, automatically populating client information from the CRM into deal flow systems eliminates manual data entry, saving valuable time and minimizing the risk of human error.

Improved Workflow Efficiency Through CRM Integration

Integrating a CRM with email, calendar, and deal flow systems creates a centralized hub for all client-related information. This consolidated view improves communication, collaboration, and ultimately, deal closure rates. For example, imagine a scenario where an investment banker has a meeting scheduled with a client (information tracked in their calendar). Upon completion, a note summarizing the meeting can be directly added to the client’s CRM record, automatically updating the deal flow system with the latest progress.

This eliminates the need for manual updates and ensures everyone on the deal team has access to the most current information.

Examples of CRM Integration Points with Popular Investment Banking Software

The importance of smooth integration with pre-existing software cannot be overstated. A well-integrated CRM avoids the creation of data silos and ensures that all information resides in a single, accessible location. This improves the speed and accuracy of decision-making.

- Email Integration: Automatic logging of emails, contact information extraction from email signatures, and the ability to directly access client CRM profiles from within the email client.

- Calendar Integration: Automatic scheduling of meetings, linking appointments to client records, and the ability to easily access client information directly from calendar entries.

- Deal Flow Systems (e.g., Bloomberg AIM, Dealogic): Automatic syncing of deal information, client details, and progress updates between the CRM and the deal flow system. This avoids data duplication and ensures consistency.

- Microsoft Office Suite Integration: The ability to directly access and edit client records from within Microsoft Word or Excel, facilitating report generation and data analysis.

- Financial Modeling Software (e.g., Excel, Argus): While direct integration may be less common, the ability to easily export client data from the CRM to support financial modeling is crucial.

Choosing the Right CRM Deployment Model

Selecting the appropriate CRM deployment model is crucial for investment banks, impacting security, scalability, and overall cost-effectiveness. The choice between cloud-based and on-premise solutions hinges on a bank’s specific needs, risk tolerance, and existing IT infrastructure.The primary deployment models available are cloud-based (Software as a Service or SaaS) and on-premise solutions. Each offers distinct advantages and disadvantages, requiring careful consideration before implementation.

Cloud-Based CRM vs. On-Premise CRM for Investment Banks

Cloud-based CRMs offer accessibility from anywhere with an internet connection, promoting collaboration and remote work capabilities, highly valuable in the geographically dispersed nature of investment banking. On-premise solutions, conversely, require dedicated server infrastructure within the bank’s own data center, providing greater control over data and customization but demanding significant upfront investment and ongoing maintenance. Scalability is generally easier with cloud solutions, as resources can be adjusted on demand, while on-premise solutions require more planning and potentially costly hardware upgrades to accommodate growth.

Data security is a key concern for both; however, reputable cloud providers invest heavily in security measures, potentially offering a more robust security posture than a smaller bank could independently maintain. Cost-wise, cloud-based solutions often involve subscription fees, predictable and scalable, while on-premise deployments involve substantial capital expenditure for hardware, software licenses, and ongoing IT support.

Security Considerations for Cloud-Based and On-Premise CRM Deployments, Best crm for investment bankers

Security is paramount in the financial industry. Cloud-based CRMs rely on the provider’s security infrastructure, including data encryption, access controls, and regular security audits. However, banks must carefully vet providers, ensuring compliance with relevant regulations (e.g., GDPR, CCPA) and industry best practices. On-premise solutions offer greater control over security, allowing banks to implement customized security protocols and maintain complete control over their data.

However, this comes with the responsibility of managing all aspects of security, requiring dedicated IT personnel and substantial investment in security hardware and software. Both models necessitate robust data loss prevention (DLP) measures, multi-factor authentication, and regular security assessments to mitigate risks. A breach in either model could have severe consequences, including financial losses, reputational damage, and regulatory penalties.

Scalability and Cost Implications of CRM Deployment Options

Cloud-based CRMs offer superior scalability, allowing banks to easily adjust their resources (storage, processing power, user licenses) as their needs evolve. This flexibility is particularly beneficial for investment banks experiencing rapid growth or seasonal fluctuations in activity. On-premise solutions, while offering customization, require significant upfront investment in hardware and software, and scaling necessitates costly hardware upgrades or server replacements. Cloud-based models typically follow a subscription-based pricing model, making costs more predictable and potentially more cost-effective in the long run, especially for smaller firms.

On-premise solutions, however, involve higher initial capital expenditure and ongoing maintenance costs, including IT staff salaries and infrastructure upkeep. For example, a rapidly growing boutique investment bank might find the scalability and predictable cost structure of a cloud-based CRM far more advantageous than the significant upfront investment and potential for unforeseen costs associated with an on-premise solution. Conversely, a large, established investment bank with extensive IT infrastructure might find an on-premise solution more suitable due to stringent internal security requirements and the ability to tightly integrate the CRM with existing systems.

Case Studies

Real-world examples highlight the transformative impact of CRMs within the demanding environment of investment banking. These case studies illustrate how effective CRM implementation can streamline operations, enhance client relationships, and ultimately drive revenue growth. The following examples showcase successful CRM deployments and their tangible benefits.

Improved Deal Flow at Global Investments

Global Investments, a mid-sized investment bank, experienced a significant bottleneck in their deal flow process. Information was scattered across various spreadsheets and email inboxes, leading to missed opportunities and inefficient communication. Implementing a CRM system centralized all deal-related information, providing a single source of truth for all team members. This allowed for better tracking of deals throughout the pipeline, from initial contact to closing.

Specifically, the CRM’s automated alerts and reporting features proactively identified stalled deals, enabling timely interventions and improved closing rates. The result was a 20% increase in deal closure within the first year of CRM implementation, directly attributable to improved efficiency and proactive deal management.

Enhanced Client Relationship Management at Apex Capital

Apex Capital, a boutique investment bank specializing in mergers and acquisitions, prioritized enhancing client relationships. Their previous system relied heavily on individual banker’s memory and informal communication, leading to inconsistencies in service and potential loss of valuable client insights. By implementing a CRM system with robust contact management and client interaction tracking features, Apex Capital created a centralized repository of client information.

This included detailed transaction histories, communication logs, and personalized client preferences. This allowed for more personalized and proactive communication with clients, leading to improved client satisfaction and loyalty. The CRM’s reporting capabilities provided valuable insights into client behavior and preferences, informing strategic client relationship management initiatives and strengthening overall client relationships. For example, the CRM highlighted a significant opportunity to cross-sell services to a key client based on their recent transaction history and stated investment goals.

CRM Implementation at Pinnacle Securities: Challenges and Successes

Pinnacle Securities, a large investment bank, faced significant challenges implementing a new CRM system across its geographically dispersed teams. Initial resistance from staff accustomed to existing processes was a major hurdle. Data migration from legacy systems proved complex and time-consuming. However, Pinnacle Securities mitigated these challenges through a phased implementation approach, focusing on training and change management initiatives.

The bank also invested in robust data migration tools and provided ongoing support to users. The successful implementation of the CRM resulted in improved data accuracy, enhanced collaboration across teams, and a more efficient sales process. While the initial investment was significant, the return on investment was realized through increased efficiency, improved client satisfaction, and a measurable increase in deal closure rates.

The improved data quality and accessibility enabled better strategic decision-making at the executive level.

Future Trends in Investment Banking CRM

The investment banking landscape is undergoing a rapid transformation, driven by technological advancements and evolving client expectations. CRM systems are no longer simply contact management tools; they are becoming integral to strategic decision-making, client relationship cultivation, and overall firm profitability. The future of investment banking CRM hinges on the seamless integration of emerging technologies and a data-driven approach to client interaction.The integration of artificial intelligence (AI) and machine learning (ML) is poised to revolutionize CRM functionalities for investment bankers.

These technologies offer the potential to automate tedious tasks, enhance predictive capabilities, and deliver personalized client experiences at an unprecedented scale.

AI and Machine Learning in Investment Banking CRM

AI and ML can significantly improve various aspects of investment banking CRM. For instance, AI-powered chatbots can handle routine client inquiries, freeing up human resources for more complex tasks. ML algorithms can analyze vast datasets to identify high-value prospects, predict market trends, and personalize marketing campaigns. Predictive analytics powered by ML can forecast client behavior, allowing bankers to proactively address potential needs and risks.

This proactive approach fosters stronger client relationships and improves business outcomes. Imagine a system that automatically flags potential churn risk based on client interaction patterns and market indicators, allowing for timely intervention and retention strategies.

Data Analytics and Reshaped CRM Functionalities

Advancements in data analytics are transforming CRM functionalities from simple record-keeping systems to powerful business intelligence tools. Investment banks can leverage data analytics to gain deeper insights into client behavior, preferences, and investment strategies. This data-driven approach enables more effective client segmentation, targeted marketing, and personalized service offerings. For example, analyzing historical transaction data combined with market trends can identify investment opportunities tailored to specific client profiles.

Furthermore, real-time data dashboards provide a comprehensive overview of client portfolios and market positions, allowing for informed and timely decision-making. This level of insight fosters stronger client relationships based on a deep understanding of individual needs and circumstances.

Emerging Technologies and Client Relationship Management

Several emerging technologies are set to further shape the future of client relationship management in investment banking. Blockchain technology, for example, could enhance data security and transparency in client transactions and communication. The increasing adoption of cloud-based CRM solutions offers scalability, accessibility, and enhanced collaboration capabilities across teams and geographical locations. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) could revolutionize client interaction by offering immersive and interactive experiences, potentially including virtual presentations and client portfolio reviews.

This shift towards a more personalized and technology-driven approach will redefine how investment banks engage with their clients, fostering loyalty and driving growth.

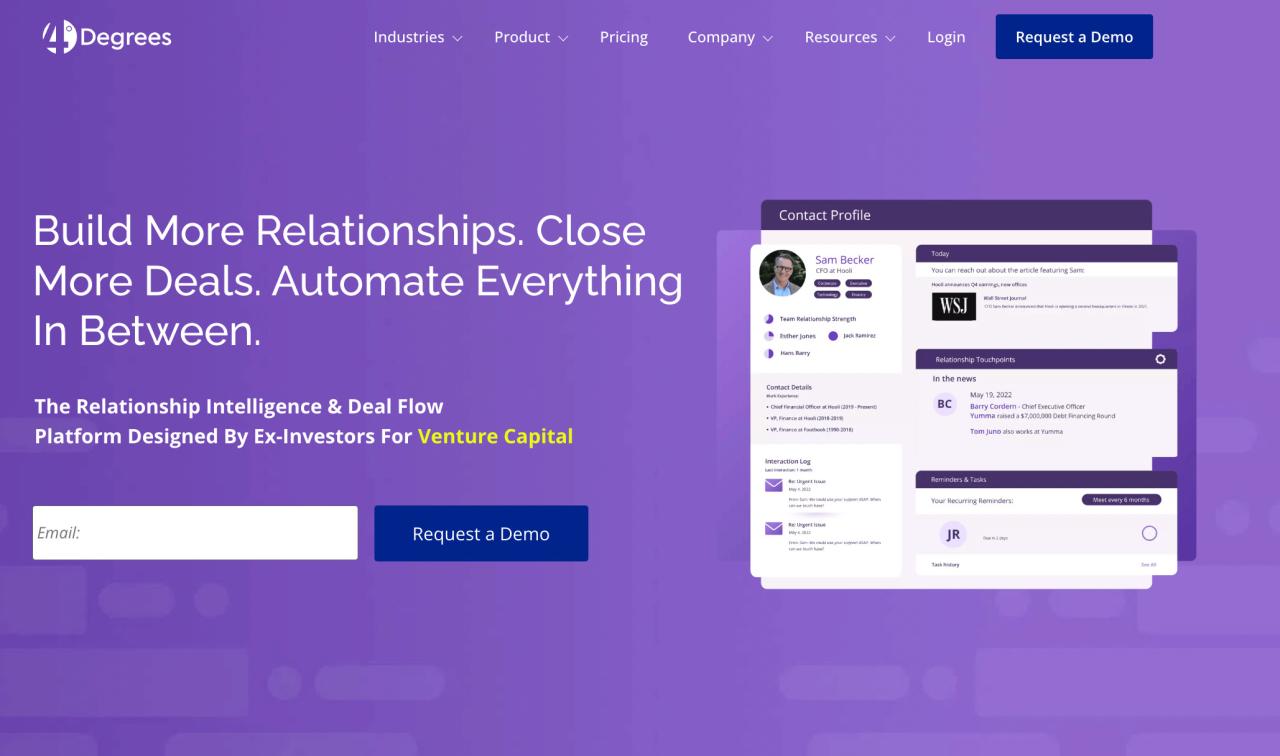

Illustrative Examples of CRM Interfaces

A user-friendly CRM interface for investment bankers should prioritize efficiency and clear data visualization, mirroring the fast-paced nature of the industry. The design should streamline workflows, enabling quick access to crucial information and minimizing time spent navigating complex systems. Effective data visualization is key to identifying trends and opportunities rapidly.A well-designed CRM dashboard for an investment banker might feature several key components.

Imagine a screen divided into easily digestible sections, each providing a snapshot of critical information. This visual representation allows for immediate comprehension of key performance indicators and important client interactions.

Investment Banker CRM Dashboard Example

The primary dashboard section could display a summary of upcoming deals, showing deal name, stage, key contacts, and projected closing dates. A visual representation, perhaps using a Gantt chart or progress bar, would clearly indicate the progress of each deal. Another section could highlight key client interactions, showing recent communications, meeting notes, and upcoming appointments, all color-coded by client priority or relationship status.

A third section might provide a real-time overview of key performance indicators (KPIs), such as deal volume, average deal size, and revenue generated, compared to previous periods and targets. This section might use charts and graphs to present the data in a visually compelling and easily interpretable manner. Finally, a newsfeed section could aggregate relevant market news and updates, ensuring the banker stays informed about industry trends and potential opportunities.

The overall aesthetic should be clean, uncluttered, and use a consistent color palette for optimal readability.

Example of a Visually Appealing Investment Banking Report

Consider a monthly performance report generated by the CRM system. This report would provide a comprehensive overview of the banker’s activities and achievements during the month. The report might begin with a summary page, showcasing key metrics such as total deals closed, revenue generated, and average deal size, presented using visually appealing charts and graphs. For instance, a bar chart could compare monthly performance against the yearly target, while a pie chart could break down revenue by deal type.

Subsequent pages would delve into more detail, providing breakdowns of deal performance by client segment, industry, or geographic region. The report could also include a detailed list of all client interactions, including meetings, phone calls, and emails, categorized for easy review and analysis. This level of detail allows for a comprehensive review of performance and the identification of areas for improvement.

The report would be designed with a professional, yet modern aesthetic, utilizing clear fonts, consistent formatting, and a logical layout. The overall style should reflect the sophistication and professionalism expected within the investment banking sector.

Final Wrap-Up

Ultimately, selecting the best CRM for an investment bank hinges on aligning its capabilities with the firm’s specific needs and long-term strategic goals. By carefully considering the factors discussed – from core functionalities and integration possibilities to deployment models and future trends – investment banks can leverage CRM technology to optimize deal flow, strengthen client relationships, and gain a competitive edge in this dynamic industry.

The right CRM isn’t just a tool; it’s a strategic investment in growth and lasting success.

Answers to Common Questions

What are the key security considerations when choosing a CRM for an investment bank?

Data security and compliance are paramount. Look for CRMs with robust encryption, access controls, audit trails, and adherence to relevant regulations like GDPR and CCPA.

How can a CRM improve my team’s collaboration?

A centralized CRM allows for real-time data sharing, facilitating better communication and collaboration among team members on deals and client interactions.

What is the typical cost of implementing a CRM for an investment bank?

Costs vary significantly depending on the chosen CRM, its features, the number of users, and implementation services. Expect a range from several thousand to hundreds of thousands of dollars annually.

Can a CRM integrate with my existing email and calendar systems?

Yes, most modern CRMs offer seamless integration with popular email and calendar platforms, improving workflow efficiency by centralizing communication and scheduling.