Best CRM for insurance agencies is a crucial decision for any firm aiming to streamline operations and enhance customer relationships. The right CRM system can significantly improve efficiency, boost sales, and foster stronger client connections, leading to increased profitability and growth. This guide explores key features, selection criteria, and implementation strategies to help insurance agencies find the perfect CRM solution.

Choosing the optimal CRM involves careful consideration of various factors, including agency size, type (independent, captive, etc.), budget, and integration needs with existing insurance software. A well-integrated CRM system can automate tasks, centralize client data, and provide valuable insights for informed decision-making, ultimately improving customer service and overall business performance.

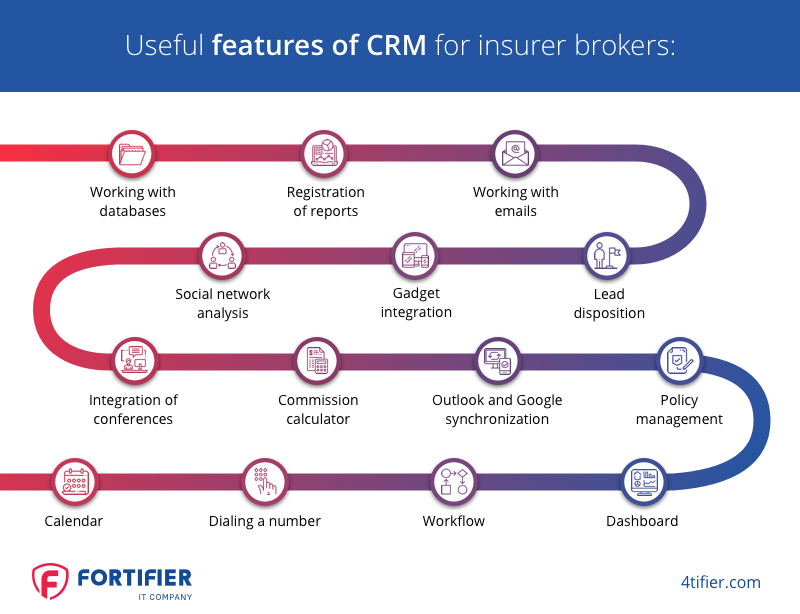

Top CRM Features for Insurance Agencies

Choosing the right CRM is crucial for insurance agencies to streamline operations, enhance customer relationships, and ultimately drive growth. A well-integrated CRM system can significantly improve efficiency across sales, marketing, and customer service departments, leading to increased profitability and better client retention. This section details essential CRM features tailored to the specific needs of the insurance industry.

Essential CRM Features for Insurance Agencies

The following table categorizes essential CRM features by functionality, highlighting their importance for insurance agencies. Effective CRM implementation requires careful consideration of these features to ensure a seamless workflow and optimized performance.

| Sales | Marketing | Customer Service | Administration |

|---|---|---|---|

| Lead Management: Capture, qualify, and track leads throughout the sales cycle. This includes features for assigning leads, managing communication history, and automating follow-ups. | Campaign Management: Plan, execute, and analyze marketing campaigns to target specific customer segments. This involves tracking campaign performance and adjusting strategies based on results. | Case Management: Efficiently track and resolve customer inquiries, complaints, and claims. This includes features for prioritizing cases, assigning them to agents, and monitoring resolution times. | Reporting and Analytics: Gain valuable insights into sales performance, marketing effectiveness, and customer behavior. Comprehensive reporting allows for data-driven decision-making. |

| Opportunity Management: Track sales opportunities, forecast revenue, and manage the sales pipeline. This helps identify potential risks and opportunities for improvement. | Email Marketing: Send targeted emails to nurture leads and engage customers. This involves features for personalization, automation, and performance tracking. | Knowledge Base: Provide easy access to frequently asked questions, policy information, and other relevant resources for both customers and agents. | User Management: Control access to the CRM system, assigning roles and permissions to different users based on their responsibilities. |

| Sales Forecasting: Predict future sales based on historical data and current trends. This helps in resource allocation and strategic planning. | Social Media Integration: Monitor social media channels for brand mentions, customer feedback, and potential leads. This helps to engage with customers on their preferred platforms. | Customer Portal: Allow customers to access their policy information, submit claims, and communicate with agents through a self-service portal. | Security and Compliance: Ensure the CRM system meets industry regulations and protects sensitive customer data. This is crucial for maintaining customer trust and avoiding penalties. |

Importance of Integration Capabilities

Seamless integration with other insurance-specific software is paramount. A standalone CRM system offers limited value without the ability to connect with policy administration systems (PAS), claims management systems, and other essential tools. For example, integrating the CRM with a PAS allows for real-time access to policy information, improving the efficiency of sales and customer service interactions. This integration prevents data silos and ensures consistency across all systems.

Without this integration, agents would need to switch between multiple systems, leading to delays, errors, and a frustrating user experience.

Cloud-Based vs. On-Premise CRM Solutions for Insurance

The choice between cloud-based and on-premise CRM solutions depends on various factors, including budget, technical expertise, and security requirements. Each option offers distinct advantages and disadvantages.

| Feature | Cloud-Based CRM | On-Premise CRM |

|---|---|---|

| Cost | Lower upfront costs, subscription-based model. Scalable to meet changing needs. | Higher upfront investment in hardware and software. Ongoing maintenance costs. |

| Accessibility | Accessible from anywhere with an internet connection. Improved collaboration among remote teams. | Limited accessibility, requires on-site access. Collaboration can be challenging for geographically dispersed teams. |

| Scalability | Easily scalable to accommodate growth. Additional resources can be added as needed. | Scaling can be complex and expensive, requiring significant hardware upgrades. |

| Maintenance | Vendor handles updates and maintenance. Reduces IT burden on the insurance agency. | Insurance agency is responsible for all maintenance, updates, and security. Requires dedicated IT staff. |

| Security | Robust security measures provided by the vendor. Compliance with industry regulations. | Insurance agency is responsible for data security and compliance. Requires significant investment in security infrastructure. |

CRM Software Selection Criteria for Insurance Businesses

Choosing the right CRM is crucial for insurance agencies of all sizes. A well-integrated system streamlines operations, improves client relationships, and ultimately boosts profitability. The selection process, however, requires careful consideration of various factors to ensure a successful implementation and return on investment.

Factors to Consider When Choosing a CRM

Selecting a CRM involves evaluating several key aspects. A thorough assessment ensures the chosen system aligns with the agency’s specific needs and long-term goals. Ignoring these factors can lead to costly mistakes and inefficient workflows.

- Budget: Determine a realistic budget encompassing software licensing fees, implementation costs, training, and ongoing maintenance. Consider both upfront and recurring expenses.

- Scalability: Choose a system that can adapt to your agency’s growth. Consider future needs, anticipating potential increases in clients, policies, and staff.

- Integration Capabilities: Assess the CRM’s ability to integrate with existing systems, such as accounting software, policy management systems, and communication platforms. Seamless data flow is essential.

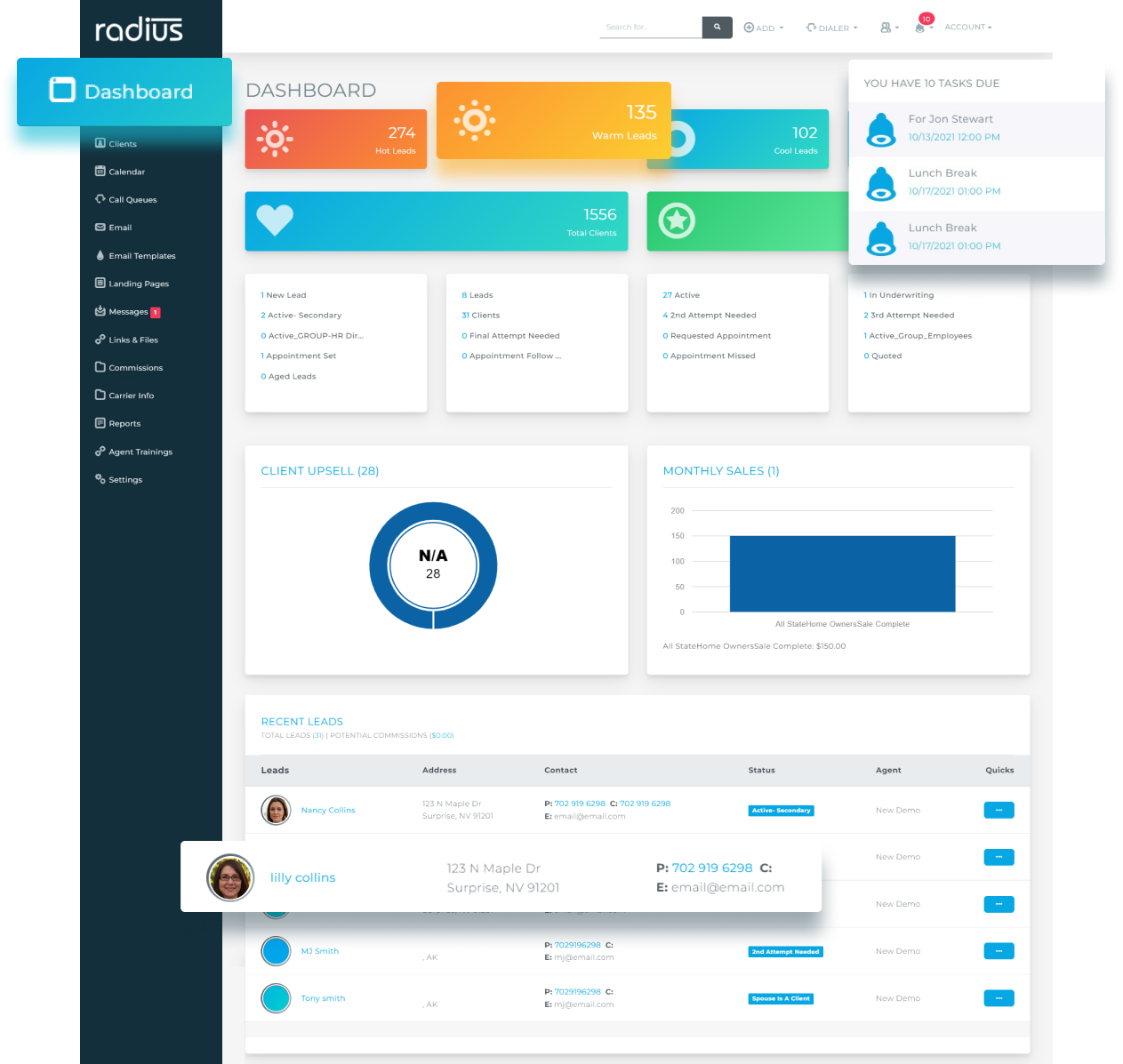

- Reporting and Analytics: The CRM should provide robust reporting and analytics capabilities to track key performance indicators (KPIs), identify trends, and inform strategic decision-making. Examples of KPIs include conversion rates, policy renewal rates, and customer acquisition costs.

- User-Friendliness: The system should be intuitive and easy for your staff to use. A complex interface can lead to low adoption rates and hinder productivity. Consider conducting user training sessions as part of the implementation plan.

- Security and Compliance: Data security is paramount in the insurance industry. Ensure the CRM complies with relevant regulations, such as HIPAA and GDPR, and offers robust security features to protect sensitive client information.

- Customer Support: Reliable customer support is crucial for resolving issues and receiving assistance when needed. Investigate the vendor’s support options, including response times and available channels.

- Customization Options: Assess the CRM’s ability to be customized to meet your agency’s unique needs. Flexibility in workflow design and data fields is beneficial.

Impact of Agency Size and Type on CRM Requirements

The ideal CRM varies significantly based on the agency’s size and structure. Independent agencies often have different needs than larger, captive agencies.

Smaller Independent Agencies: These agencies typically require a simpler, more affordable CRM with a focus on contact management, communication tracking, and basic reporting. A cloud-based solution often proves cost-effective and easily accessible.

Larger Independent Agencies and Captive Agencies: Larger agencies often require more sophisticated CRMs with advanced features such as workflow automation, complex reporting, and integration with multiple systems. They may also need features to manage multiple agents, teams, and offices effectively. A CRM with robust scalability is crucial for managing growth.

Step-by-Step Guide to CRM Evaluation and Selection

A structured approach to CRM selection ensures a successful implementation.

- Define Requirements: Clearly identify your agency’s specific needs and goals for a CRM. Involve key stakeholders in this process to ensure all perspectives are considered.

- Research and Shortlist Vendors: Research different CRM vendors and shortlist those that appear to meet your requirements. Consider online reviews, industry recommendations, and vendor demonstrations.

- Request Demonstrations: Request demonstrations from your shortlisted vendors to see the CRM in action. Pay close attention to the user interface, reporting capabilities, and integration options.

- Compare and Contrast: Create a comparison chart to evaluate the different CRMs based on your defined requirements and the vendor demonstrations. This allows for a side-by-side analysis of features, pricing, and support.

- Pilot Program (Optional): Consider conducting a pilot program with a small group of users before a full-scale implementation. This allows you to test the CRM in a real-world setting and identify any potential issues.

- Select and Implement: Once you’ve selected a CRM, work with the vendor to implement the system. Ensure adequate training is provided to your staff to maximize adoption and utilization.

Case Studies

Successful CRM implementations in the insurance industry demonstrate significant improvements in efficiency and customer relationships. These case studies highlight the strategies used, challenges overcome, and the measurable impact on key performance indicators. Examining these real-world examples provides valuable insights for insurance agencies considering CRM adoption.

Analyzing successful CRM implementations reveals common themes: careful planning, robust data migration, comprehensive employee training, and ongoing system optimization. Challenges often include resistance to change from staff, integration complexities with existing systems, and the need for continuous data quality management. Successful strategies involve clear communication, strong leadership support, and a phased implementation approach.

Successful CRM Implementation at a Regional Insurance Brokerage

A regional insurance brokerage, serving primarily small businesses, implemented a CRM system to improve client communication and streamline sales processes. They chose a cloud-based solution for scalability and accessibility.

- Improved Client Communication: The CRM allowed for automated email marketing campaigns, personalized client communications, and efficient tracking of interactions. This resulted in a 15% increase in client retention within the first year.

- Streamlined Sales Processes: Sales team members could access complete client histories, including previous quotes and policies, leading to faster sales cycles and a 10% increase in sales conversion rates.

- Challenges Overcome: Initial resistance from some brokers concerned about learning new software was addressed through comprehensive training sessions and ongoing support. Data migration from their legacy system required careful planning and meticulous data cleansing to ensure accuracy.

Enhanced Customer Service Through CRM at a National Life Insurance Company, Best crm for insurance agencies

A national life insurance company deployed a CRM system to enhance customer service and improve policy management. The CRM system was integrated with their existing policy administration system.

- Improved Policy Management: Agents gained instant access to policy details, simplifying the process of answering customer inquiries and resolving issues. This led to a significant reduction in customer service call handling time.

- Personalized Customer Interactions: The CRM facilitated personalized communications, allowing agents to tailor their interactions to individual customer needs and preferences. Customer satisfaction scores increased by 8% after implementation.

- Challenges Overcome: Integrating the CRM with the existing policy administration system proved challenging, requiring custom development and extensive testing. The company addressed this by forming a cross-functional team with representatives from IT, operations, and sales.

Data-Driven Insights and Improved Sales Forecasting with CRM in a Commercial Insurance Firm

A commercial insurance firm implemented a CRM system with advanced analytics capabilities to gain data-driven insights and improve sales forecasting. The CRM was chosen for its robust reporting and analytics features.

- Improved Sales Forecasting: The CRM provided detailed sales pipeline data, enabling the sales team to accurately forecast future revenue and adjust sales strategies accordingly. This led to a 5% increase in sales revenue prediction accuracy.

- Data-Driven Insights: The CRM’s analytics tools allowed the firm to identify key customer segments, optimize marketing campaigns, and personalize sales pitches, resulting in a 7% increase in sales conversion rates.

- Challenges Overcome: The initial investment in the CRM system was substantial. The company mitigated this by demonstrating a clear return on investment (ROI) through improved sales and reduced operational costs. They also phased the implementation to manage costs effectively.

Cost and ROI of CRM Systems in the Insurance Industry

Implementing a CRM system represents a significant investment for insurance agencies, but the potential return on that investment can be substantial. Understanding the associated costs and developing a strategy to measure ROI is crucial for justifying the expense and ensuring successful implementation. This section will explore the various cost factors, pricing models, and methods for calculating ROI in the insurance context.

Typical Costs Associated with CRM Implementation and Maintenance

The total cost of ownership (TCO) for a CRM system extends beyond the initial purchase price. It encompasses various factors throughout the system’s lifecycle. These costs can be categorized into upfront implementation costs and ongoing maintenance costs. Upfront costs typically include software licensing fees, implementation consulting services, data migration, customization, and employee training. Ongoing costs include monthly or annual subscription fees (depending on the pricing model), ongoing technical support, system maintenance and updates, and potentially additional user licenses as the agency grows.

For example, a small agency might spend $5,000-$15,000 upfront on software and implementation, while larger agencies could easily spend $50,000 or more. Annual maintenance costs can range from a few hundred dollars to several thousand, depending on the complexity of the system and the level of support required.

CRM Pricing Models and Their Implications

Insurance agencies typically encounter two main CRM pricing models: subscription-based and one-time purchase. Subscription-based models involve recurring monthly or annual payments for access to the software and its features. This model offers predictable budgeting and often includes automatic updates and technical support. One-time purchase models require a larger upfront investment but eliminate ongoing subscription fees. However, this model often necessitates separate payments for updates, support, and maintenance, potentially leading to unpredictable expenses over time.

The choice between these models depends heavily on the agency’s budget, long-term plans, and risk tolerance. A rapidly growing agency might prefer the scalability of a subscription model, while a smaller, more established agency might find a one-time purchase more cost-effective in the long run, provided they can manage the ongoing maintenance costs effectively.

Strategies for Calculating Return on Investment (ROI) from a CRM System

Calculating the ROI of a CRM system requires a careful assessment of both costs and benefits. A common approach involves quantifying the improvements in efficiency and productivity resulting from CRM implementation. For example, reduced administrative time spent on data entry, improved lead conversion rates, increased cross-selling opportunities, and better customer retention can all contribute to a positive ROI.

A simplified ROI calculation can be expressed as:

ROI = (Net Benefits – Total Costs) / Total Costs

To illustrate, consider an agency that invests $10,000 in a CRM system. If the CRM leads to a $20,000 increase in revenue over the first year due to improved efficiency and sales, the ROI would be:

ROI = ($20,000 – $10,000) / $10,000 = 1.0 or 100%

This calculation, however, is a simplification. A more comprehensive approach would involve detailed cost accounting and a thorough analysis of the various benefits, possibly incorporating discounted cash flow analysis for long-term projections. It is important to consider both tangible benefits (increased revenue, reduced costs) and intangible benefits (improved customer satisfaction, enhanced employee morale) when assessing the overall ROI. The key is to establish clear, measurable goals before implementing the CRM and to track key performance indicators (KPIs) regularly to monitor progress and measure the impact on the bottom line.

Integration with Other Insurance Technologies

A robust CRM system for an insurance agency isn’t just a contact database; it’s the central hub connecting all aspects of your business. Seamless integration with other crucial insurance technologies is paramount for efficiency, accuracy, and a superior customer experience. Failing to integrate these systems results in data silos, duplicated effort, and ultimately, lost revenue.Effective integration streamlines workflows, minimizes manual data entry, and provides a holistic view of each client’s policy, claims history, and interactions with your agency.

This unified view empowers agents to provide more personalized and informed service, leading to increased client satisfaction and retention. Conversely, poor integration can lead to significant inefficiencies and potential errors, impacting both operational costs and the bottom line.

Policy Administration System Integration

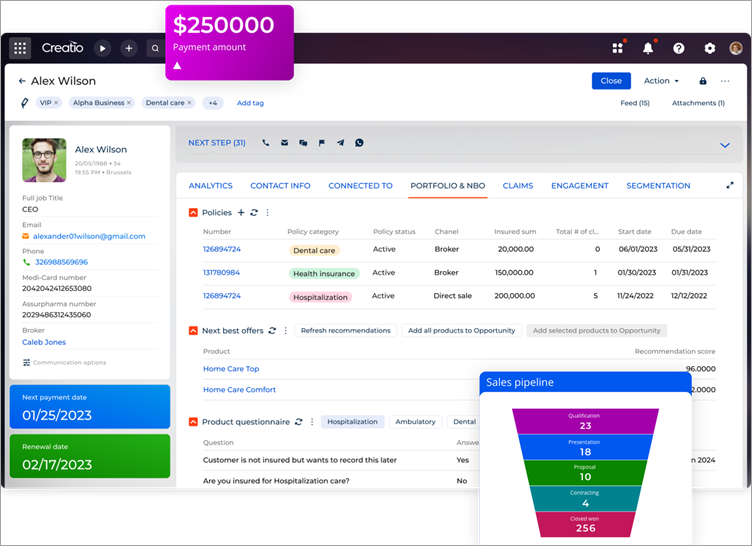

Integrating your CRM with your policy administration system (PAS) allows for real-time access to policy details, renewal dates, and coverage information directly within the CRM. This eliminates the need for agents to switch between multiple systems, saving time and reducing the risk of errors caused by manual data entry. For example, when a client calls with a question about their policy, the agent can instantly access all relevant information within the CRM, leading to a faster and more efficient resolution.

This improved efficiency directly translates to cost savings and improved customer service. Furthermore, automated alerts regarding upcoming renewals or policy changes can be seamlessly integrated into the CRM workflow, prompting agents to proactively engage with clients.

Claims Processing Software Integration

Linking your CRM to your claims processing software provides a complete picture of a client’s claim history, including status updates, payments, and communication logs. This integrated view allows agents to effectively manage client expectations and provide timely updates. Imagine a scenario where a client contacts the agency to inquire about the status of their claim. With integrated systems, the agent can immediately access the claim’s current status, relevant documentation, and communication history, providing a precise and reassuring response.

This proactive approach enhances client trust and minimizes frustration associated with claim processing.

Integration Challenges and Best Practices

Data synchronization and integration complexities can present significant challenges. Different systems may use varying data formats and structures, requiring careful mapping and transformation to ensure accurate data flow. Furthermore, maintaining data integrity across multiple systems necessitates robust data validation and error-handling mechanisms. Best practices include employing standardized data formats (like XML or JSON), using APIs for seamless data exchange, and implementing regular data reconciliation processes to identify and resolve discrepancies.

Investing in professional integration services can significantly mitigate these challenges and ensure a successful implementation. Prioritizing robust data security measures throughout the integration process is also crucial to protect sensitive client information.

Data Security and Compliance in Insurance CRM

The insurance industry handles highly sensitive personal and financial data, making robust data security and compliance paramount. Choosing a CRM system that prioritizes these aspects is crucial for maintaining client trust, adhering to legal requirements, and avoiding potentially devastating financial and reputational consequences. Failure to comply with regulations can lead to significant fines, legal action, and damage to an agency’s brand.Data security and privacy regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe, impose strict requirements on how sensitive data is collected, stored, processed, and protected.

These regulations cover a wide range of aspects, including data encryption, access control, data breach notification, and individual rights regarding their personal information. Insurance agencies must ensure their CRM systems are fully compliant with all applicable regulations.

Data Protection Measures in Insurance CRM Systems

Implementing effective data protection measures within a chosen CRM requires a multi-layered approach. This includes technical safeguards, such as data encryption both in transit and at rest, robust access control mechanisms, and regular security audits. It also encompasses administrative controls, like employee training on data security best practices, the establishment of clear data handling policies, and incident response plans to address potential breaches.

Furthermore, physical security measures are important, protecting servers and physical data storage from unauthorized access. A well-defined data retention policy, specifying how long data is stored and when it is securely deleted, is another crucial component.

Data Encryption and Access Control

Data encryption is a cornerstone of data security. It transforms readable data into an unreadable format, rendering it inaccessible to unauthorized individuals even if a breach occurs. There are various encryption methods, including symmetric and asymmetric encryption, each with its own strengths and weaknesses. Choosing the appropriate method depends on the specific security needs and the sensitivity of the data being protected.

Access control, implemented through user roles and permissions, restricts access to sensitive data based on individual needs and responsibilities. This prevents unauthorized users from viewing, modifying, or deleting confidential information. For example, a claims adjuster might have access to claim details but not to client financial information, while a sales representative might have access to client contact details but not to policy specifics.

This granular level of control significantly reduces the risk of data breaches and unauthorized access.

CRM Training and Support for Insurance Professionals

Effective CRM implementation hinges on comprehensive training and ongoing support. Insurance professionals need to understand not only the system’s functionalities but also how to leverage it to improve efficiency, enhance customer relationships, and ultimately drive revenue growth. A well-structured training program and readily available support resources are crucial for maximizing the return on investment in CRM software.A successful CRM implementation requires more than just installing the software; it necessitates equipping your staff with the knowledge and skills to utilize it effectively.

Ongoing support ensures the system remains optimized, addresses emerging challenges, and adapts to the evolving needs of the insurance agency. This section details a sample training program and explores the importance of ongoing support and readily available resources.

Sample CRM Training Program for Insurance Agency Staff

This program is designed to equip insurance agency staff with the necessary skills to effectively use a CRM system. The program is modular, allowing for customization based on specific roles and responsibilities within the agency.

- Module 1: Introduction to the CRM SystemThis module covers the basic functionalities of the CRM system, including navigation, data entry, and report generation. Participants will learn how to log in, navigate the user interface, and understand the different modules available. Hands-on exercises will reinforce learning.

- Module 2: Contact ManagementThis module focuses on effectively managing client and prospect information within the CRM. Topics include data entry best practices, contact segmentation, and utilizing the CRM for lead nurturing. Practical exercises will involve creating and managing contacts, assigning tasks, and tracking interactions.

- Module 3: Policy ManagementThis module demonstrates how to use the CRM to manage insurance policies, track renewals, and identify cross-selling opportunities. Participants will learn how to link policies to contacts, record policy details, and generate reports on policy status. Real-world scenarios will be used to practice these tasks.

- Module 4: Reporting and AnalyticsThis module covers the generation and interpretation of reports from the CRM system. Participants will learn how to create custom reports to track key performance indicators (KPIs) such as conversion rates, sales pipelines, and customer satisfaction. They will learn to analyze data to identify trends and areas for improvement.

- Module 5: Advanced Features and CustomizationThis module explores more advanced features of the CRM, such as workflow automation, integration with other systems, and custom report creation. This module caters to power users and administrators. Hands-on exercises will allow participants to customize the CRM to their specific needs.

Importance of Ongoing Support and Maintenance for Optimal CRM Performance

Ongoing support and maintenance are vital for sustained CRM performance. Regular maintenance prevents data corruption, ensures system stability, and enables proactive identification and resolution of potential issues. Proactive support minimizes downtime, maximizes user productivity, and ensures the CRM continues to meet the evolving needs of the insurance agency. For example, regular software updates ensure compatibility with new technologies and address security vulnerabilities.

A dedicated support team can provide timely assistance with technical issues, troubleshooting, and user training, preventing disruptions to workflows and maintaining optimal performance.

Resources Available for CRM Training and Support in the Insurance Industry

Several resources are available to support CRM training and maintenance within the insurance industry. These include vendor-provided training materials, online tutorials, webinars, and professional consulting services. Many CRM vendors offer comprehensive training programs, including online courses, instructor-led workshops, and on-site training sessions tailored to the specific needs of insurance agencies. Industry associations and professional organizations often provide resources and networking opportunities related to CRM implementation and best practices.

Third-party consultants specializing in CRM implementation and support can provide valuable expertise in system optimization, data migration, and user training. Furthermore, online forums and communities offer a platform for sharing knowledge, troubleshooting issues, and learning from the experiences of other insurance professionals.

Closing Notes

Selecting the best CRM for your insurance agency is a strategic investment that can yield substantial returns. By carefully evaluating your needs, researching available options, and implementing a well-defined strategy, you can transform your agency’s operations, improve client relationships, and drive significant growth. Remember that ongoing training and support are crucial for maximizing the value of your CRM investment. The right CRM system is not merely a tool; it’s a catalyst for enhanced efficiency and lasting success in the competitive insurance landscape.

FAQ Corner: Best Crm For Insurance Agencies

What is the average cost of an insurance CRM?

Costs vary greatly depending on features, vendor, and agency size. Expect a range from a few hundred dollars per month for basic plans to several thousand for enterprise-level solutions.

How long does it take to implement a CRM?

Implementation timeframes range from a few weeks to several months, depending on the complexity of the system and the agency’s size and processes.

What are the key performance indicators (KPIs) to track after CRM implementation?

Key KPIs include customer retention rate, sales conversion rates, policy renewal rates, customer satisfaction scores, and agent productivity.

Can a CRM integrate with my existing accounting software?

Many CRMs offer integrations with popular accounting software, but compatibility should be verified before purchase. Check the CRM’s API and integration capabilities.