Best CRM for health insurance agents is more than just software; it’s a strategic investment in efficiency and growth. The right CRM can transform how you manage leads, nurture relationships, and ultimately, close more deals. This exploration delves into the key features, pricing models, and integration capabilities crucial for selecting the perfect CRM tailored to the unique needs of health insurance professionals.

We’ll examine how the right system can streamline your workflow, enhance client communication, and ultimately contribute to a significant return on investment.

Choosing the right CRM involves careful consideration of several factors, including your agency’s size, budget, and specific requirements. This guide aims to equip you with the knowledge necessary to make an informed decision, ensuring you select a system that not only meets your current needs but also scales effectively as your business expands. We’ll explore various options, highlighting their strengths and weaknesses to help you navigate the complexities of the CRM marketplace and find the ideal solution to boost your agency’s success.

Top CRM Features for Health Insurance Agents

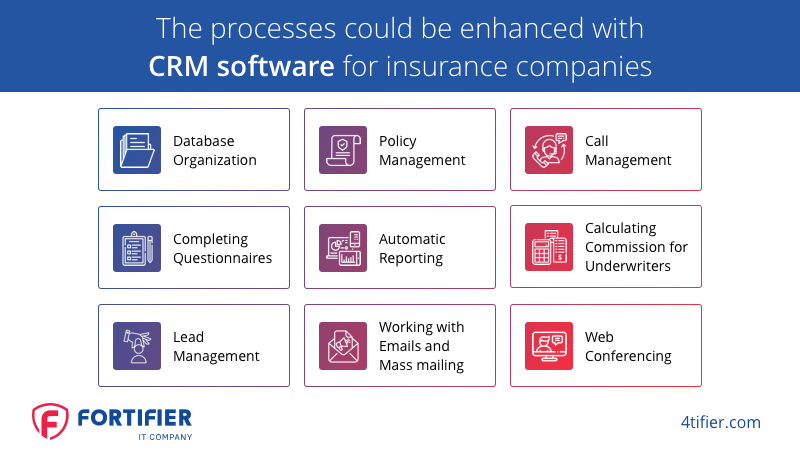

Choosing the right CRM can significantly impact a health insurance agent’s productivity and sales success. A well-integrated CRM streamlines workflows, improves client relationships, and ultimately boosts revenue. This section details essential CRM features that are particularly beneficial for this specialized industry.

Lead Management Capabilities

Effective lead management is crucial for health insurance agents. A CRM should offer robust lead capture features, allowing agents to gather contact information from various sources – online forms, referrals, events, etc. The system should then automatically qualify and prioritize leads based on predefined criteria, such as age, location, health status (if permissible and ethically sourced), and insurance needs.

This prioritization ensures that agents focus their efforts on the most promising leads, maximizing their conversion rates. Furthermore, lead nurturing capabilities, such as automated email sequences and personalized follow-ups, help maintain engagement and move leads through the sales pipeline.

Contact Management and Communication Tools

A CRM should provide a centralized repository for all client information, including contact details, policy information, communication history, and any relevant notes from previous interactions. This 360-degree view of each client enables agents to provide personalized and informed service. Integrated communication tools, such as email marketing, SMS messaging, and phone integration, allow for efficient and consistent communication across multiple channels.

This helps agents maintain contact with clients, schedule appointments, and provide timely updates. The ability to track communication history within the CRM also ensures consistent and effective client engagement.

Integrated Appointment Scheduling and Calendar Management

Efficient time management is critical for health insurance agents. A CRM with integrated appointment scheduling and calendar management capabilities simplifies this process. Agents can easily schedule appointments with clients, send reminders, and manage their schedules from a single platform. The ability to integrate with external calendars, such as Google Calendar or Outlook, further enhances efficiency. This feature minimizes scheduling conflicts, reduces missed appointments, and maximizes the agent’s productive time.

Furthermore, the ability to link appointments directly to client profiles within the CRM creates a comprehensive record of all client interactions.

Comparison of Popular CRMs for Health Insurance Agents

The following table compares three popular CRMs, highlighting their strengths and weaknesses for health insurance agents. Consider these features when selecting a system that best aligns with your specific needs and budget.

| Feature | Salesforce Sales Cloud | HubSpot CRM | Zoho CRM |

|---|---|---|---|

| Lead Management | Excellent lead scoring and routing; robust automation | Strong lead nurturing tools; user-friendly interface | Good lead management, but may require customization for advanced features |

| Contact Management | Comprehensive contact database; customizable fields | Simple and intuitive contact management; easy data entry | Robust contact management; good for managing large client bases |

| Communication Tools | Seamless email and call integration; robust reporting | Strong email marketing capabilities; user-friendly interface | Good email and SMS integration; some limitations with advanced features |

| Appointment Scheduling | Requires third-party integration; robust reporting | Limited native scheduling features; requires third-party integration for advanced features | Good native scheduling features; integrates well with other Zoho applications |

| Pricing | High cost; scalable options available | Freemium model; cost increases with features | Affordable; various plans available |

| Ease of Use | Steeper learning curve; requires training | User-friendly; easy to learn and implement | Relatively easy to use; good for users with limited technical skills |

CRM Pricing and Value for Health Insurance Agencies

Choosing the right CRM is a significant investment for health insurance agencies. The cost should be carefully weighed against the potential return, considering factors like agency size, sales volume, and desired features. Understanding the various pricing models and their associated benefits is crucial for making an informed decision.

CRM Pricing Models: A Comparison

Three leading CRMs—Salesforce Sales Cloud, HubSpot CRM, and Zoho CRM—offer different pricing models to cater to diverse agency needs. Salesforce Sales Cloud typically employs a tiered subscription model, with pricing escalating based on the number of users and the features included. Higher tiers unlock advanced functionalities like sophisticated analytics and automation tools. HubSpot CRM offers a freemium model, providing a basic version for free with paid options for expanded features and user capacity.

Zoho CRM follows a similar tiered structure to Salesforce, but generally offers more affordable entry-level plans. Each platform offers a range of options, allowing agencies to select the plan that best aligns with their budget and requirements.

Return on Investment (ROI) from CRM Implementation

The ROI from implementing a CRM in a health insurance agency can be substantial. Improved lead management, streamlined sales processes, and enhanced client communication all contribute to increased sales and reduced operational costs. For example, a small agency might see a 15-20% increase in sales conversion rates by effectively managing leads and tracking client interactions. Larger agencies with more complex operations could potentially realize even greater gains through improved efficiency and data-driven decision-making.

The key to maximizing ROI is proper implementation, training, and ongoing utilization of the CRM’s features.

Cost-Effectiveness and CRM Scalability

Cost-effectiveness in CRM selection hinges on finding a balance between features, scalability, and pricing. A smaller agency with limited resources might find a freemium model or a basic tiered plan sufficient, focusing on essential features like contact management and lead tracking. As the agency grows, it can upgrade to a higher tier to accommodate increased user numbers and access more advanced features.

Conversely, a large agency might benefit from a more robust, enterprise-level solution like Salesforce Sales Cloud, despite the higher upfront cost, to handle its extensive data and complex workflows. Scalability ensures that the chosen CRM can adapt to the agency’s evolving needs without requiring a complete system overhaul.

Cost-Benefit Analysis of Three Leading CRMs

| Feature | Salesforce Sales Cloud | HubSpot CRM | Zoho CRM |

|---|---|---|---|

| Pricing Model | Tiered Subscription | Freemium/Tiered | Tiered Subscription |

| Starting Price (per user/month) | ~$25 | Free (basic)/~$50 (Professional) | ~$14 |

| Key Features (Contact Management, Lead Tracking, Sales Automation, Reporting/Analytics) | All included in higher tiers; some basic features in lower tiers | Basic features in free version; advanced features in paid tiers | All included in higher tiers; some basic features in lower tiers |

| Scalability | Highly scalable | Moderately scalable | Highly scalable |

| Estimated ROI (based on increased sales conversion and efficiency) | 15-30% (depending on agency size and usage) | 10-20% (depending on agency size and usage) | 10-25% (depending on agency size and usage) |

Integration with Health Insurance Platforms and Systems

Seamless integration with various health insurance platforms and systems is crucial for a CRM to truly enhance the efficiency and productivity of health insurance agents. A well-integrated CRM streamlines workflows, minimizes data entry, and ensures data accuracy, ultimately leading to improved client service and increased sales. This integration is not merely a convenience; it’s a necessity for staying competitive in today’s fast-paced insurance market.Effective CRM integration significantly reduces manual data entry, a major time sink for agents.

By automatically pulling information from various sources, the CRM eliminates redundancy and the risk of human error associated with re-keying data. This results in more time available for agents to focus on building client relationships and closing deals, improving overall productivity. Accurate and readily accessible data empowers agents to make informed decisions, tailor their offerings to specific client needs, and ultimately achieve better outcomes.

Key Systems for Integration

A robust CRM for health insurance agents should seamlessly integrate with several key systems to optimize workflows. These include insurance carrier systems for accessing real-time policy information, quoting engines for generating accurate and competitive quotes, and potentially electronic health record (EHR) systems for a more holistic client view (depending on privacy regulations and client consent). Integration with these systems ensures a unified view of client data, streamlining processes from initial contact to policy issuance and beyond.

Benefits of Integration for Efficiency and Data Accuracy

The benefits of integrating a CRM with health insurance platforms extend beyond simple data synchronization. Real-time access to policy information, for example, allows agents to quickly address client inquiries and resolve issues efficiently. Automated quoting streamlines the sales process, providing instant quotes and reducing the time it takes to close a deal. Furthermore, a centralized database minimizes data inconsistencies and ensures that all information is accurate and up-to-date, improving the overall quality of client service.

This accuracy reduces errors and potential compliance issues.

Examples of Successful CRM Integrations

Several health insurance companies have successfully implemented CRM systems integrated with various platforms. For instance, a large national insurer integrated their CRM with their internal quoting engine and carrier systems. This integration allowed agents to generate quotes instantly, access real-time policy details, and manage client interactions within a single platform. The result was a significant reduction in processing time and improved agent productivity, with measurable increases in sales conversions.

Another example involves a smaller agency using a CRM that integrated with several different carrier systems, enabling agents to quickly compare plans and find the best options for their clients. This improved client satisfaction and led to increased client retention.

Essential API Functionalities for Optimal Integration

To ensure optimal integration, the CRM and health insurance platforms must support a robust set of API functionalities. The following functionalities are essential:

- Real-time data synchronization: Bidirectional data flow between the CRM and external systems ensures data consistency and accuracy.

- Secure authentication and authorization: Protecting sensitive client and policy data is paramount.

- Support for various data formats: Flexibility in handling different data structures from various sources is crucial.

- Robust error handling and logging: Identifying and resolving integration issues efficiently is essential for maintaining system stability.

- Webhooks for real-time notifications: Receiving instant updates on policy changes or other relevant events ensures timely action.

CRM User Experience and Training for Health Insurance Agents

A user-friendly CRM is crucial for successful adoption and maximizing its value within a health insurance agency. Agents need a system that seamlessly integrates into their workflow, allowing them to focus on client needs rather than navigating complex software. Poor UX can lead to low adoption rates, wasted investment, and ultimately, a decline in productivity and revenue. Therefore, selecting a CRM with an intuitive interface and providing comprehensive training is paramount.The effectiveness of a CRM for health insurance agents hinges heavily on its user experience.

A positive user experience fosters increased engagement, improves data accuracy, and boosts overall efficiency. Conversely, a frustrating and difficult-to-use system can lead to data entry errors, missed opportunities, and ultimately, dissatisfied agents and clients.

Intuitive Navigation and User-Friendly Interfaces

Intuitive navigation is paramount. Features like a clear dashboard displaying key metrics (e.g., upcoming appointments, overdue tasks, lead conversion rates), easily searchable client databases, and streamlined workflows for common tasks (e.g., policy updates, claim submissions) contribute significantly to a positive user experience. The system should be designed to minimize the number of clicks required to complete tasks, reducing agent frustration and improving efficiency.

A clean, uncluttered interface with clear visual cues and logical information architecture are also essential. For instance, color-coding of client statuses (e.g., new lead, potential client, active client) can instantly convey important information, while a well-organized menu system ensures agents can quickly access the tools they need.

Features Contributing to a Positive User Experience

Several features enhance the user experience for health insurance professionals. These include customizable dashboards allowing agents to prioritize relevant information, robust reporting and analytics tools providing insights into performance and areas for improvement, integrated communication tools (e.g., email, phone, text messaging) enabling seamless client interaction, and mobile accessibility allowing agents to manage their work from anywhere. Seamless integration with other essential tools like electronic health records (EHR) systems also streamlines workflows and reduces data duplication.

For example, if the CRM can automatically pull client health information from the EHR system, it eliminates manual data entry and reduces the risk of errors. The ability to personalize the CRM to individual agent preferences, such as preferred layouts and notification settings, further enhances user satisfaction and productivity.

Onboarding and Training Best Practices

Effective onboarding and training are critical for successful CRM implementation. A well-structured training program should encompass various methods, including online modules, instructor-led sessions, and ongoing support. This multi-faceted approach caters to different learning styles and ensures that agents feel confident and proficient in using the system. The training should be tailored specifically to the needs of health insurance professionals, highlighting the features most relevant to their daily tasks.

Providing access to ongoing support through FAQs, online tutorials, or dedicated support staff is essential for addressing any questions or challenges that may arise after the initial training. Regular refresher training sessions can help maintain proficiency and keep agents updated on any new features or updates to the system.

Step-by-Step Training Guide for New Users, Best crm for health insurance agents

A structured approach to training is crucial. The following steps Artikel a potential training program:

- Introduction to the CRM: Overview of the system’s purpose and key features. This should include a demonstration of the user interface and navigation.

- Client Management Module: Training on adding, updating, and searching for client information, including contact details, policy information, and communication history.

- Lead Management Module: Training on capturing and managing leads, including assigning leads to agents, tracking interactions, and converting leads into clients.

- Communication Tools: Training on using the integrated communication tools, including email, phone, and text messaging features. This will cover best practices for effective communication with clients.

- Reporting and Analytics: Training on generating reports and analyzing data to track key performance indicators (KPIs) and identify areas for improvement.

- Task Management Module: Training on creating, assigning, and tracking tasks to ensure efficient workflow management. This includes setting deadlines and prioritizing tasks.

- Integration with other systems: Training on how the CRM integrates with other systems used by the agency, such as EHR systems and insurance platforms.

- Hands-on Practice and Q&A: A dedicated session for practical application of the learned skills, allowing agents to work through realistic scenarios and ask questions.

This structured approach, combined with ongoing support and regular refresher training, ensures agents are confident and proficient in utilizing the CRM to its full potential.

Data Security and Compliance in Health Insurance CRM

Protecting client data is paramount for health insurance agents. The sensitive nature of health information necessitates robust security measures and strict adherence to regulations like HIPAA. A CRM system’s security features directly impact an agent’s ability to maintain client trust and avoid potentially severe legal and financial consequences.Choosing a CRM for your health insurance agency requires careful consideration of data security and compliance.

Failure to adequately protect sensitive client information can lead to breaches, fines, and reputational damage. This section details essential security features and compliance protocols to ensure the privacy and security of protected health information (PHI).

HIPAA Compliance Requirements for Health Insurance CRMs

HIPAA (Health Insurance Portability and Accountability Act) mandates stringent security and privacy rules for protecting PHI. A CRM used by health insurance agents must be compliant with these rules, which cover the electronic transmission, storage, and access of patient data. This includes ensuring data encryption both in transit and at rest, implementing access controls to restrict unauthorized access, and maintaining comprehensive audit trails to track all data activity.

Non-compliance can result in significant penalties. For instance, a 2022 study by the HHS Office for Civil Rights showed a substantial increase in HIPAA violation fines, highlighting the importance of proactive compliance.

Security Features Essential for Protecting Client Data

A secure CRM for health insurance agents should incorporate several key features. These include robust data encryption using methods like AES-256 to protect data both in transit and at rest. Multi-factor authentication (MFA) adds an extra layer of security by requiring multiple forms of verification before granting access. Access controls based on roles and responsibilities ensure that only authorized personnel can view and modify specific data.

Regular security audits and vulnerability assessments identify and address potential weaknesses in the system. Finally, comprehensive audit trails meticulously record all data access, modifications, and deletions, allowing for effective tracking and investigation in case of a security incident.

Security Protocols and Best Practices for Data Privacy

Implementing effective security protocols is critical for maintaining data privacy. Regular software updates are essential to patch security vulnerabilities. Employee training programs should educate staff on data security best practices, including password management, phishing awareness, and the importance of protecting client information. Data loss prevention (DLP) tools can help prevent sensitive data from leaving the system unauthorized.

Furthermore, implementing a robust business continuity and disaster recovery plan ensures data availability in case of unforeseen events. This plan should include data backups stored offsite, and a well-defined procedure for restoring data in case of system failure.

Checklist of Essential Security and Compliance Measures

Before selecting a CRM, thoroughly review these essential security and compliance measures:

- HIPAA Compliance Certification: Verify that the CRM provider has obtained the necessary certifications to ensure compliance with HIPAA regulations.

- Data Encryption: Confirm that both data in transit and at rest are encrypted using strong encryption algorithms (e.g., AES-256).

- Access Controls: Assess the CRM’s access control mechanisms, ensuring granular permissions based on roles and responsibilities.

- Multi-Factor Authentication (MFA): Verify that the CRM supports MFA to enhance security and prevent unauthorized access.

- Audit Trails: Check for comprehensive audit trails that record all data access, modifications, and deletions.

- Data Backup and Recovery: Ensure the CRM provider has a robust data backup and recovery plan in place.

- Security Audits and Vulnerability Assessments: Inquire about the frequency of security audits and vulnerability assessments performed by the provider.

- Employee Training: Determine if the provider offers resources or training materials to educate users on data security best practices.

- Data Loss Prevention (DLP) Measures: Assess the CRM’s capabilities to prevent sensitive data from leaving the system unauthorized.

- Compliance Reporting: Check whether the CRM provides tools to assist with HIPAA compliance reporting requirements.

Choosing the Right CRM Based on Agency Size and Needs: Best Crm For Health Insurance Agents

Selecting the ideal CRM hinges significantly on the size and specific requirements of your health insurance agency. A system perfectly suited for a small, independent agency might be vastly insufficient or overly complex for a large national firm. Understanding this crucial relationship between agency size and CRM functionality is paramount for efficient operations and maximizing return on investment.

CRM Solutions for Different Agency Sizes

The needs of a health insurance agency change dramatically depending on its size. Small agencies often prioritize simplicity and affordability, while medium-sized agencies require more advanced features and scalability. Large enterprises demand robust systems capable of handling massive data volumes and complex workflows. For instance, a small agency might find a basic CRM with contact management and lead tracking sufficient, whereas a large agency would require sophisticated features like advanced reporting, automation, and integration with multiple insurance platforms.

Scalability and its Impact on CRM Selection

Scalability refers to a CRM’s ability to adapt to the growing needs of an agency. A small agency choosing a CRM should consider its potential for growth. A system that can easily handle increased data volume, user accounts, and complex functionalities without requiring a complete system overhaul will save time and money in the long run. For example, a cloud-based CRM generally offers better scalability compared to an on-premise solution, allowing agencies to easily add users and features as their business expands.

Conversely, a small agency investing in a large, enterprise-level CRM might find it unnecessarily expensive and complex for its current needs.

Feature and Pricing Alignment with Agency Needs

The features and pricing of a CRM should directly reflect the needs and budget of the agency. Small agencies might opt for a less expensive, streamlined CRM with core functionalities like contact management, lead tracking, and basic reporting. Medium-sized agencies may require more advanced features such as sales automation, marketing automation, and more sophisticated reporting capabilities, justifying a higher price point.

Large agencies often need enterprise-level CRMs with extensive customization options, advanced analytics, and robust security features, accepting a significantly higher cost to match their complex operational requirements. Consider the cost per user, implementation costs, and ongoing maintenance fees when evaluating pricing.

Decision Tree for CRM Selection

The following decision tree guides health insurance agencies in choosing a suitable CRM:

| Question | Answer | Recommended CRM Type |

|---|---|---|

| What is the size of your agency? | Small (fewer than 10 agents) | Basic CRM with contact management and lead tracking |

| Medium (10-50 agents) | Mid-range CRM with sales and marketing automation | |

| Large (50+ agents) | Enterprise-level CRM with advanced analytics and customization | |

| What is your budget? | Limited | Consider cloud-based solutions with subscription models |

| Moderate | Explore various options; balance features and price | |

| Extensive | Invest in enterprise-level solutions with comprehensive features | |

| What are your key priorities? | Simplicity and affordability | Prioritize ease of use and essential features |

| Scalability and automation | Choose a system that can adapt to growth and automate tasks | |

| Advanced analytics and reporting | Select a CRM with robust reporting and data visualization tools |

Wrap-Up

Ultimately, selecting the best CRM for your health insurance agency is a crucial step toward optimizing your operations and achieving sustainable growth. By carefully weighing factors such as essential features, pricing models, integration capabilities, user experience, and data security, you can confidently choose a system that empowers your team, streamlines your workflow, and ultimately enhances your ability to serve clients effectively.

Remember, the right CRM is an investment in your agency’s future, paving the way for increased efficiency, improved client relationships, and ultimately, greater success in a competitive market.

FAQ Summary

What is HIPAA compliance, and why is it crucial for health insurance CRMs?

HIPAA (Health Insurance Portability and Accountability Act) mandates the protection of sensitive patient health information. A HIPAA-compliant CRM ensures your client data remains secure and confidential, meeting legal requirements and building client trust.

How can a CRM improve my sales process?

A CRM streamlines lead management, automates follow-ups, and provides valuable insights into client interactions, allowing for more efficient sales cycles and increased conversion rates.

What are the typical costs associated with CRM solutions?

Pricing varies widely depending on features, scalability, and vendor. Expect monthly subscription fees, potentially with tiered pricing based on user numbers and functionalities.

What kind of training is involved in implementing a new CRM?

Most vendors offer training resources, including tutorials, webinars, and sometimes on-site support. The complexity of training depends on the CRM’s features and your team’s technical proficiency.