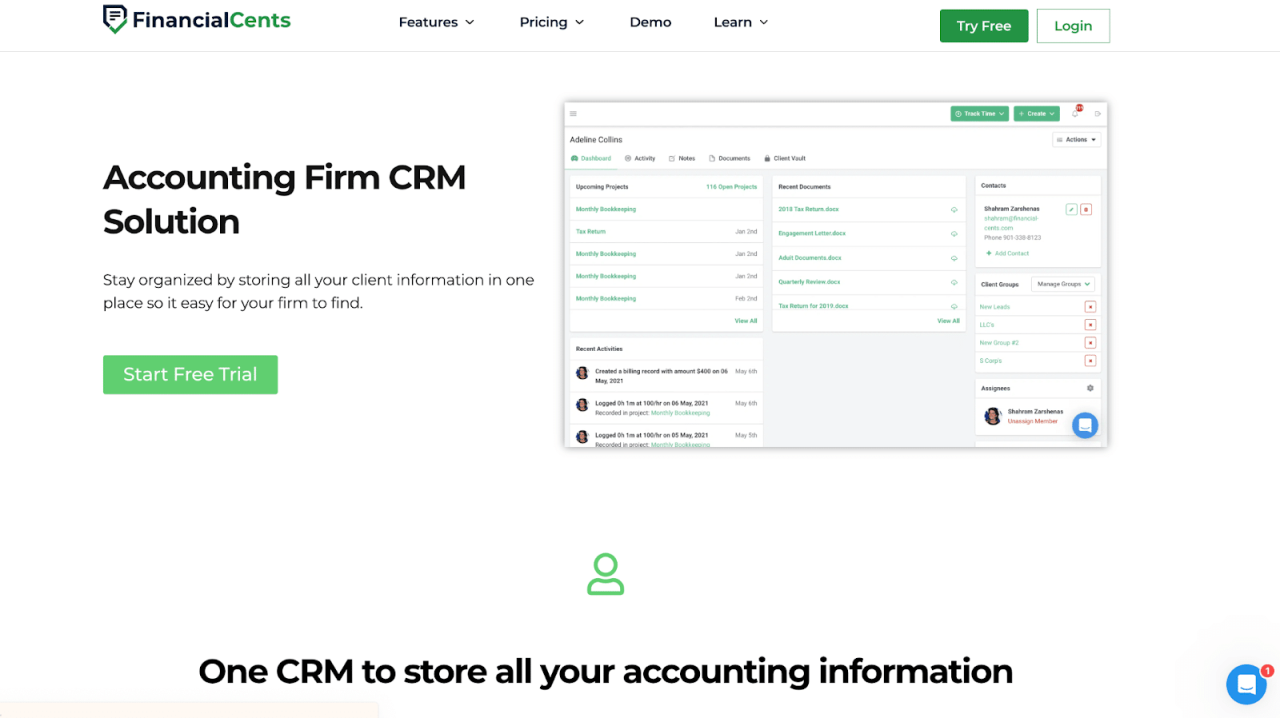

Best CRM for CPA firms is more than just software; it’s a strategic investment in efficiency and client satisfaction. Finding the right CRM can significantly impact a CPA firm’s ability to manage clients, projects, and data effectively. This exploration delves into the critical features, top platforms, and implementation strategies to help CPA firms optimize their operations and achieve greater success.

From streamlining client onboarding and automating tasks to generating insightful reports and enhancing client communication, a well-chosen CRM system can revolutionize how a CPA firm operates, especially during peak seasons like tax time. This guide will provide a comprehensive overview of the key considerations and best practices for selecting and implementing the ideal CRM solution tailored to the specific needs of CPA firms.

CPA Firm Specific Needs

CPA firms face unique challenges in managing their client relationships and operational efficiency. A robust CRM system is crucial for overcoming these hurdles and achieving sustainable growth. This section will explore key challenges and the essential features a CRM should possess to address them effectively.

Key Challenges Faced by CPA Firms

Three significant challenges faced by CPA firms regarding client management are: maintaining accurate client data, managing complex projects and deadlines across multiple clients, and generating insightful reports for strategic decision-making. These challenges often lead to inefficiencies, missed deadlines, and difficulties in providing exceptional client service.

Essential CRM Features for CPA Firms

To effectively address the aforementioned challenges, a CRM for CPA firms must include several key features. These include a centralized client database with robust contact management capabilities, integrated project management tools to track deadlines and task assignments, and comprehensive reporting and analytics dashboards to provide actionable insights into client interactions and firm performance. Furthermore, seamless integration with accounting software is vital for streamlining workflows and eliminating data duplication.

Comparison of CRM Features: Contact Management, Project Management, and Reporting

Contact management, project management, and reporting are all critical features of a CRM for CPA firms, but their relative importance varies depending on the firm’s specific needs and size. Contact management ensures accurate and readily accessible client information, facilitating personalized communication and efficient service delivery. This is paramount for building strong client relationships. Project management capabilities are essential for managing the complexities of tax preparation, audits, and other client engagements, ensuring timely completion and minimizing risks.

Finally, robust reporting features enable firms to track key performance indicators (KPIs), identify areas for improvement, and make data-driven decisions regarding resource allocation and strategic planning. While contact management forms the foundation, effective project management ensures timely service delivery, and reporting offers the strategic oversight needed for long-term success.

Benefits of CRM Integration with Accounting Software

Integrating a CRM with accounting software offers significant benefits to CPA firms. It eliminates data silos, streamlines workflows, and improves accuracy. By connecting client data across both systems, firms can automate tasks such as invoice generation, payment tracking, and reporting. This reduces manual data entry, minimizes errors, and frees up staff time for higher-value activities. Furthermore, it provides a single source of truth for all client-related information, enhancing collaboration and improving decision-making.

Integration Options for Popular Accounting Software

| Accounting Software | CRM Integration Methods | Data Synced | Notes |

|---|---|---|---|

| Xero | API Integration, Third-party apps | Client details, invoices, payments | Many CRMs offer pre-built integrations. |

| QuickBooks Online | API Integration, Third-party apps | Client details, invoices, payments | Similar to Xero, extensive integration options exist. |

| Sage Intacct | API Integration | Client details, financial data, project information | Robust API allows for extensive customization. |

| Zoho Books | API Integration, Third-party apps | Client details, invoices, payments | Often integrates well with Zoho CRM. |

CRM Software Features for CPA Firms

Choosing the right CRM is crucial for CPA firms to manage client relationships, improve efficiency, and ultimately, boost profitability. A well-integrated CRM system can streamline workflows, automate tasks, and provide valuable insights into client behavior, leading to better service and increased client retention. This section details essential features for optimal CRM functionality within a CPA firm.

Must-Have Features for Efficient Client Onboarding

Efficient client onboarding is key to establishing strong client relationships from the outset. A streamlined process minimizes administrative burden and allows your team to focus on providing high-quality service. The following features are crucial for a smooth onboarding experience.

- Centralized Client Database: A single, easily accessible repository for all client information (contact details, tax history, financial statements, etc.) eliminates data silos and ensures everyone has the information they need.

- Automated Intake Forms: Digital forms automate the collection of essential client data, reducing manual paperwork and ensuring consistency.

- Document Management System: Secure storage and easy access to all client-related documents (contracts, tax returns, correspondence) improve organization and reduce the risk of losing crucial information.

- Workflow Automation: Automated workflows guide new clients through the onboarding process, ensuring all necessary steps are completed efficiently and consistently.

- Secure Communication Portal: A secure platform for communication with clients allows for easy exchange of documents and information, maintaining confidentiality.

Benefits of Automation Features

Automation significantly boosts efficiency and frees up valuable time for your team to focus on higher-value tasks. Specifically, email marketing and appointment scheduling offer substantial benefits.Email marketing capabilities within a CRM allow for targeted communication with clients, promoting timely tax planning, offering relevant services, and building relationships. Automated appointment scheduling simplifies the process of booking consultations and meetings, reducing scheduling conflicts and improving client satisfaction.

This automated communication reduces manual effort, improves response times, and contributes to a more professional image. For example, automated email reminders for upcoming deadlines reduce missed appointments and improve client compliance.

Improving Client Communication and Efficiency with CRM Reporting

CRM reporting provides valuable insights into client interactions and performance. During tax season, this is especially important. For example, reports can track the number of clients onboarded, the average processing time for tax returns, and the number of client inquiries. This data helps identify bottlenecks, optimize workflows, and improve communication. Reports on client engagement can also be used to proactively address client concerns and improve satisfaction.

For instance, identifying clients with overdue documents allows for timely follow-up, reducing delays and potential penalties. Real-time dashboards provide an at-a-glance view of key metrics, enabling proactive management of workload and resources.

Streamlining Client Inquiry and Request Handling

A well-designed CRM system can significantly improve the handling of client inquiries and requests. The following workflow diagram illustrates this process:

Workflow Diagram: Handling Client Inquiries and Requests

Step 1: Client submits inquiry (phone, email, portal).

Step 2: Inquiry is automatically logged in the CRM and assigned to the appropriate team member.

Step 3: Team member addresses the inquiry, updating the CRM with actions taken and communication details.

Step 4: Client receives a response (email, phone call, portal update).

Step 5: The inquiry is marked as resolved in the CRM.

All communication and actions are documented for future reference.

Step 6: The CRM generates reports on inquiry types, response times, and resolution rates to help improve efficiency and client service.

Top CRM Platforms Comparison

Choosing the right CRM is crucial for CPA firms to streamline operations, enhance client relationships, and improve overall efficiency. This section compares three leading CRM platforms, considering their pricing models, feature sets, and scalability to help you make an informed decision. We will also examine the key differences between cloud-based and on-premise solutions, along with crucial security and data privacy considerations specific to the CPA industry.

Cloud-Based vs. On-Premise CRM Solutions for CPA Firms

The choice between cloud-based and on-premise CRM solutions significantly impacts a CPA firm’s infrastructure, budget, and security posture. Cloud-based CRMs, like Salesforce Sales Cloud or Zoho CRM, offer accessibility from anywhere with an internet connection, automatic updates, and typically lower upfront costs. However, they rely on a third-party provider for data security and maintenance. On-premise solutions, conversely, require significant upfront investment in hardware and software, along with ongoing IT maintenance.

They offer greater control over data security and customization but lack the inherent flexibility and accessibility of cloud-based options. For many CPA firms, the scalability and cost-effectiveness of cloud-based solutions outweigh the perceived security benefits of on-premise systems, especially given the robust security measures offered by reputable cloud providers. A small firm might find an on-premise solution overly complex and expensive, while a large firm with substantial IT infrastructure might find it a more manageable solution.

Security and Data Privacy Considerations When Choosing a CRM for a CPA Firm

CPA firms handle highly sensitive client data, making data security and privacy paramount when selecting a CRM. Compliance with regulations like GDPR and CCPA is non-negotiable. Key considerations include data encryption both in transit and at rest, access control mechanisms (role-based permissions), regular security audits, and disaster recovery plans. Cloud-based providers often offer robust security features, including multi-factor authentication and intrusion detection systems.

However, firms should carefully review the provider’s security certifications and compliance reports before committing. For on-premise solutions, the firm is responsible for maintaining all aspects of security, requiring a dedicated IT team or external support. Regular security training for employees is also crucial, regardless of the chosen solution.

Client Data Segmentation and Personalized Communication

Effective client management relies on the ability to segment client data and deliver personalized communications. CRMs facilitate this by allowing firms to categorize clients based on various criteria (e.g., industry, service type, revenue). This segmentation allows for targeted marketing campaigns, tailored service offerings, and proactive communication relevant to each client segment. For instance, a CPA firm might segment clients by industry to send relevant tax updates or market specialized services.

Advanced CRM platforms offer features like automated email sequences, personalized email templates, and reporting dashboards to track the effectiveness of these communication strategies. This level of personalization enhances client relationships, increases client retention, and ultimately improves the firm’s bottom line. The ability to easily create and manage these segments is a crucial feature to consider when comparing CRM platforms.

Top CRM Platforms Comparison, Best crm for cpa firms

The following table compares three leading CRM platforms suitable for CPA firms: Salesforce Sales Cloud, Zoho CRM, and HubSpot CRM.

| Feature | Salesforce Sales Cloud | Zoho CRM | HubSpot CRM |

|---|---|---|---|

| Pricing | Starts at $25/user/month; varies widely based on features and users. | Starts at $14/user/month; various plans available. | Free plan available; paid plans start at $450/month; pricing varies significantly based on features and users. |

| Features | Extensive features, including sales force automation, marketing automation, analytics dashboards, and app integrations. Highly customizable. | Robust features, including contact management, sales pipeline management, marketing automation, and reporting. Good value for money. | Strong focus on inbound marketing and sales; includes CRM, email marketing, and contact management. User-friendly interface. |

| Scalability | Highly scalable; suitable for firms of all sizes. | Scalable; suitable for small to medium-sized firms. | Scalable; suitable for small to medium-sized firms; enterprise solutions available. |

Implementation and Training

Successfully implementing a new CRM system requires careful planning and comprehensive training. A phased approach minimizes disruption and ensures staff adoption, ultimately maximizing the return on investment. This section details a step-by-step implementation plan, a sample training program, key performance indicators (KPIs) for success measurement, and best practices for data migration.Implementing a new CRM system within a CPA firm involves more than just installing software; it’s about integrating it into existing workflows and fostering a culture of data-driven decision-making.

A well-structured plan is crucial to ensure a smooth transition and avoid costly errors.

Step-by-Step CRM Implementation Plan

This plan Artikels a phased approach to implementing a new CRM system, focusing on minimizing disruption and maximizing user adoption.

- Needs Assessment and System Selection: Thoroughly analyze your firm’s current processes and identify specific needs. This informs the selection of a CRM system that aligns with those needs and your budget.

- Project Team Formation: Assemble a cross-functional team representing various departments (e.g., accounting, tax, audit) to ensure diverse perspectives and buy-in.

- Data Migration Planning: Develop a detailed data migration plan, including data cleansing, transformation, and validation steps. This minimizes data loss and ensures data accuracy in the new system.

- System Configuration and Customization: Configure the CRM system to match your firm’s specific workflows and reporting requirements. This might include custom fields, workflows, and integrations with other software.

- User Training and Go-Live: Conduct comprehensive training for all users, focusing on practical application and troubleshooting. A phased rollout can minimize disruption during the initial go-live phase.

- Post-Implementation Monitoring and Optimization: Continuously monitor system usage, identify areas for improvement, and adjust configurations as needed. Regular feedback from users is vital.

Sample Training Program

Effective training is crucial for maximizing CRM adoption. The training should be practical, hands-on, and tailored to different user roles and skill levels.The training program should include:

- Introduction to the CRM System: Overview of the system’s functionality and benefits.

- Data Entry and Management: Detailed instructions on how to accurately enter and manage client data, including contact information, engagements, and documents.

- Reporting and Analytics: Training on generating reports and analyzing data to track key performance indicators (KPIs).

- Workflow Automation: Demonstrations of how to automate tasks such as email marketing, appointment scheduling, and task management.

- Integration with Other Systems: Instructions on how to integrate the CRM system with other software used by the firm, such as accounting software and document management systems.

- Troubleshooting and Support: Information on how to troubleshoot common issues and access support resources.

- Ongoing Support and Refresher Training: Regular refresher training sessions and ongoing support to address any questions or issues.

Key Performance Indicators (KPIs) for CRM Success

Tracking KPIs provides insights into the effectiveness of the CRM implementation and identifies areas for improvement.Examples of relevant KPIs include:

- Client Acquisition Cost (CAC): Measures the cost of acquiring a new client.

- Client Lifetime Value (CLTV): Estimates the total revenue generated by a client over their relationship with the firm.

- Sales Cycle Length: Tracks the time it takes to close a deal.

- Lead Conversion Rate: Measures the percentage of leads that convert into clients.

- User Adoption Rate: Tracks the percentage of staff actively using the CRM system.

- Data Accuracy Rate: Measures the accuracy of data entered into the system.

Best Practices for Data Migration

Careful planning is essential for minimizing disruption during data migration.

- Data Cleansing: Before migrating data, thoroughly clean and standardize it to ensure accuracy and consistency.

- Phased Migration: Migrate data in phases, starting with a small subset of data to test the process and identify any issues.

- Data Mapping: Create a detailed mapping document that Artikels how data from the old system will be mapped to the new system.

- Data Validation: After migration, validate the data to ensure accuracy and completeness.

- Backup and Recovery Plan: Develop a backup and recovery plan to protect against data loss.

Future Trends in CRM for CPA Firms

The landscape of Customer Relationship Management (CRM) is constantly evolving, driven by technological advancements and shifting client expectations. For CPA firms, staying ahead of these trends is crucial for maintaining a competitive edge and providing superior service. The next five years will likely see significant changes in how CPA firms leverage CRM to manage client relationships, streamline operations, and enhance profitability.

Emerging Technologies Impacting CPA Firm CRMs

Three key emerging technologies poised to significantly impact CRM solutions for CPA firms in the coming years are artificial intelligence (AI), blockchain technology, and advanced data analytics. AI will automate tasks, improve data analysis, and personalize client interactions. Blockchain’s security and transparency features can revolutionize data management and auditing processes within the firm. Advanced data analytics will provide deeper insights into client behavior, allowing for more proactive service and improved strategic decision-making.

These technologies, when integrated effectively, can transform the way CPA firms operate.

Benefits of AI and Machine Learning Integration in CPA Firm CRMs

Integrating AI and machine learning into CRM systems offers several significant advantages for CPA firms. AI can automate repetitive tasks such as data entry, appointment scheduling, and basic client communication, freeing up valuable employee time for more complex and strategic work. Machine learning algorithms can analyze large datasets to identify patterns and trends, helping firms predict client needs, anticipate potential risks, and proactively address potential issues.

For instance, a machine learning model could identify clients likely to require tax planning services based on their transaction history, allowing the firm to proactively reach out and offer assistance. This proactive approach fosters stronger client relationships and increases revenue opportunities. Furthermore, AI-powered chatbots can provide immediate support to clients, answering frequently asked questions and resolving simple issues, enhancing client satisfaction and reducing the workload on human staff.

CRM Adaptation to Changing Client Needs and Regulatory Requirements

CRM systems must be adaptable to meet the evolving needs of clients and comply with changing regulatory requirements. Clients increasingly expect personalized, omnichannel experiences, requiring CRM systems that can seamlessly integrate various communication channels (email, phone, social media, etc.). Furthermore, the regulatory landscape is constantly shifting, with new laws and compliance standards frequently emerging. CRM systems must be capable of tracking and managing compliance-related data, ensuring the firm remains compliant and avoids potential penalties.

For example, a CPA firm dealing with international clients needs a CRM system capable of handling various data privacy regulations like GDPR and CCPA. The CRM should offer features that facilitate compliance with these regulations, such as data encryption, consent management, and data subject access requests. Adaptability is key; the CRM should be capable of configuration and updates to meet future needs and regulations without extensive re-implementation.

Impact of Emerging Trends on Daily CPA Firm Operations

The integration of these future trends will significantly impact the daily operations of a CPA firm in several ways:

- Increased Efficiency: Automation of repetitive tasks will free up staff time for higher-value activities.

- Improved Client Service: Personalized communication and proactive service will enhance client satisfaction.

- Enhanced Data Security: Blockchain technology will enhance data security and transparency.

- Data-Driven Decision Making: Advanced analytics will provide valuable insights for strategic planning.

- Reduced Operational Costs: Automation and efficiency gains will lead to cost savings.

- Improved Compliance: CRM systems will help ensure compliance with evolving regulations.

- Increased Revenue Generation: Proactive client engagement and improved service will lead to increased revenue opportunities.

Epilogue

Selecting the best CRM for a CPA firm requires careful consideration of specific needs and long-term goals. By understanding the essential features, evaluating leading platforms, and implementing a robust training program, CPA firms can leverage CRM technology to enhance efficiency, improve client relationships, and ultimately drive growth. The right CRM isn’t just a tool; it’s a strategic partner in achieving sustainable success.

FAQ Section: Best Crm For Cpa Firms

What is the average cost of a CRM for a CPA firm?

The cost varies greatly depending on the chosen platform, features, and number of users. Expect to find options ranging from affordable monthly subscriptions to more substantial enterprise-level solutions.

How long does it typically take to implement a new CRM system?

Implementation timelines depend on the firm’s size and complexity, but generally range from a few weeks to several months. Thorough planning and user training are crucial for a smooth transition.

What data security measures should a CPA firm prioritize when choosing a CRM?

Prioritize platforms with robust security features like encryption, access controls, and compliance with relevant data privacy regulations (e.g., GDPR, HIPAA). Regular security audits are also recommended.