Best CRM for Bookkeepers: Finding the right Customer Relationship Management (CRM) system can revolutionize a bookkeeping business. This guide explores the key features, pricing models, and selection criteria to help bookkeepers choose the perfect CRM to boost efficiency, improve client relationships, and ultimately, increase profitability. We’ll delve into the functionalities crucial for bookkeeping, examining how integration with accounting software and payment gateways streamlines workflows and enhances overall performance.

From understanding the importance of client management and reporting tools to mastering advanced features like automation and workflow management, this comprehensive guide will equip you with the knowledge needed to make an informed decision. We will also discuss practical implementation strategies, including data migration and training programs, ensuring a smooth transition to your new CRM system.

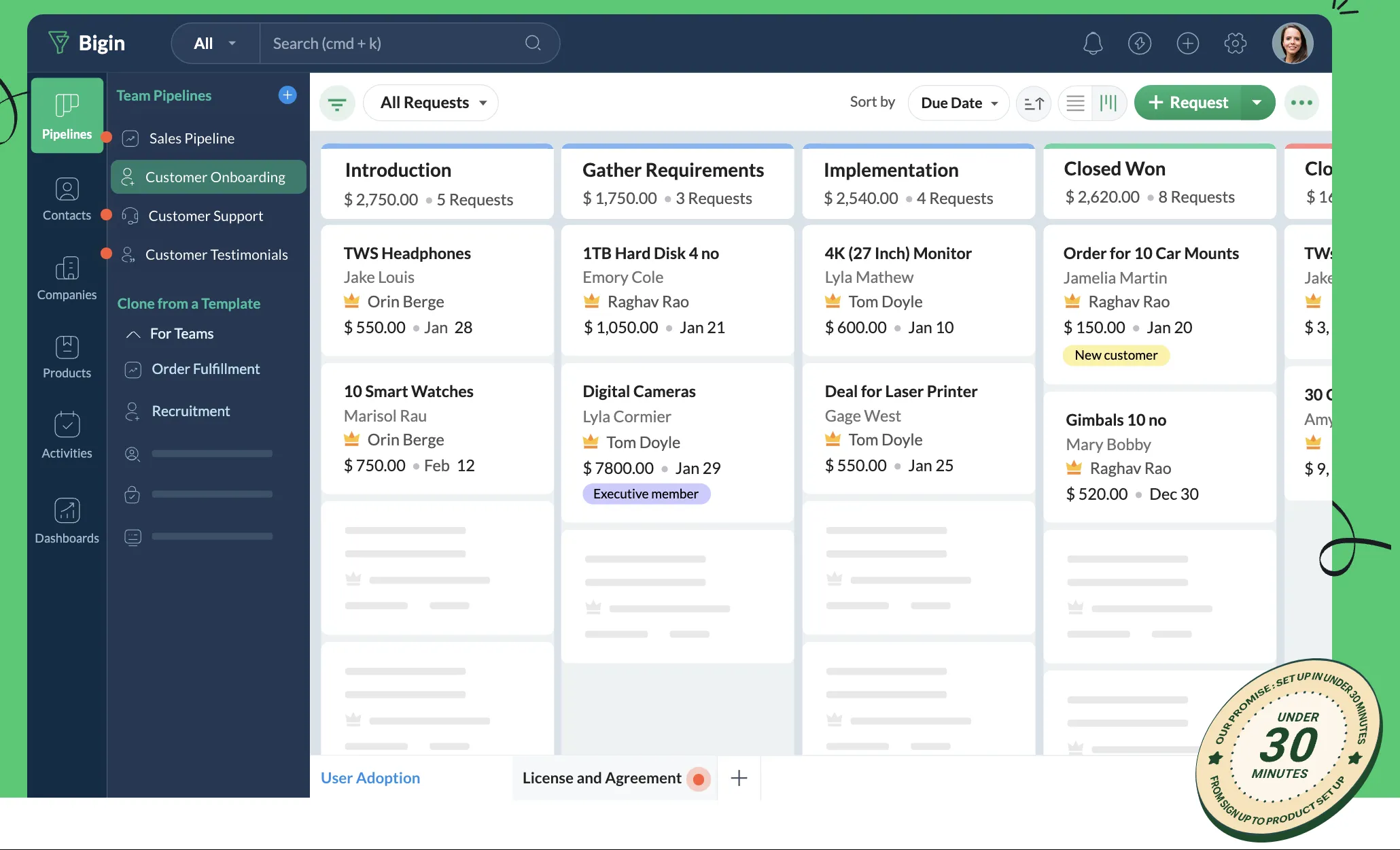

Top CRM Features for Bookkeepers

Choosing the right CRM can significantly streamline a bookkeeper’s workflow, improving efficiency and client satisfaction. A well-integrated CRM allows for centralized client data management, automated processes, and enhanced reporting capabilities, ultimately leading to a more profitable and less stressful business. This section details key CRM features vital for bookkeepers and compares popular options.

CRM Feature Comparison for Bookkeepers

The selection of a CRM should depend heavily on the specific needs of the bookkeeping business. Below is a comparison of several popular CRMs, highlighting features crucial for bookkeepers. Note that features and pricing can change, so always verify directly with the provider.

| Feature | Zoho CRM | Xero | QuickBooks Online | FreshBooks | HubSpot CRM |

|---|---|---|---|---|---|

| Client Management (Contact details, communication history, notes) | Excellent; robust contact management with customizable fields. | Good; integrated with Xero’s accounting features. | Good; integrated with QuickBooks’ accounting features. | Excellent; intuitive interface focused on client interaction. | Excellent; robust contact management with strong automation capabilities. |

| Invoicing & Billing | Good; offers invoicing but may require integration with other tools for optimal functionality. | Excellent; seamlessly integrated with Xero’s accounting features. | Excellent; seamlessly integrated with QuickBooks’ accounting features. | Excellent; core functionality, strong invoicing features. | Good; invoicing capabilities available through integrations. |

| Expense Tracking | Fair; requires integration with expense tracking apps. | Good; integrated expense tracking within Xero. | Good; integrated expense tracking within QuickBooks. | Good; expense tracking capabilities available. | Fair; requires integration with expense tracking apps. |

| Reporting & Analytics | Good; offers various reporting options, but customization might require technical expertise. | Excellent; robust reporting features directly linked to financial data. | Excellent; robust reporting features directly linked to financial data. | Good; provides basic reporting on income and expenses. | Good; reporting features available, but customization might be limited in the free version. |

| Integration Capabilities | Excellent; integrates with a wide range of third-party apps. | Excellent; integrates well with other Xero products and many third-party apps. | Excellent; integrates well with other Intuit products and many third-party apps. | Good; integrates with popular payment gateways and some accounting apps. | Excellent; extensive integration options with various marketing and sales tools. |

Client Onboarding Workflow with CRM

A streamlined client onboarding process is critical for efficiency. Using a CRM, this process can be automated and significantly improved. The following details a typical workflow:

Imagine a visual flowchart. The first box is labeled ” New Client Inquiry“. An arrow leads to ” Initial Contact & Data Collection” (box 2), where client details are recorded in the CRM. Next, ” Contract & Onboarding Documents” (box 3) are sent, and their acceptance is tracked within the CRM. An arrow leads to ” Setup in Accounting Software” (box 4), where the client’s information is added to the accounting system.

Finally, an arrow leads to ” Ongoing Communication & Support” (box 5), where all future interactions are logged and tracked within the CRM, ensuring a complete record of the client relationship.

Importance of CRM Integrations for Bookkeepers, Best crm for bookkeepers

Seamless integration between a CRM and other business tools is paramount for bookkeepers. This eliminates data silos, reduces manual data entry, and minimizes errors. For instance, integrating a CRM with accounting software like Xero or QuickBooks allows for automatic transfer of invoice data, eliminating the need for manual data entry. Similarly, integrating with payment gateways like Stripe or PayPal streamlines payment processing and provides real-time updates on payments received.

Integrating with document management systems ensures all client documents are stored securely and are easily accessible. This interconnected approach drastically reduces the risk of human error and significantly increases efficiency.

CRM Pricing and Value for Bookkeeping Businesses

Choosing the right CRM can significantly impact a bookkeeping business’s efficiency and profitability. Understanding the various pricing models and their potential return on investment is crucial for making an informed decision. This section explores different CRM pricing structures, provides a case study highlighting the benefits of CRM implementation, and examines the ROI for bookkeeping firms of varying sizes.

Different CRMs offer diverse pricing models, each with its own advantages and disadvantages. Selecting the best option depends heavily on the size and specific needs of your bookkeeping business.

CRM Pricing Models Comparison

Here’s a comparison of pricing models for three popular CRMs frequently used by bookkeepers. Note that pricing can vary based on features, add-ons, and contract length. Always check the vendor’s website for the most up-to-date information.

- CRM A (e.g., Xero): Typically uses a subscription-based model with tiered pricing. Lower tiers offer basic features suitable for solo bookkeepers or very small firms, while higher tiers unlock more advanced features like automation and custom reporting, ideal for larger teams. Pricing might range from $X per month for basic plans to $Y per month for premium plans, often with additional per-user fees.

- CRM B (e.g., Zoho CRM): Offers a similar tiered subscription model, but often with a wider range of options. They may also have a free plan with limited functionality, useful for startups testing the waters. Paid plans typically start at a lower price point than CRM A, but the cost can scale up rapidly depending on the number of users and features required.

Per-user pricing is common.

- CRM C (e.g., HubSpot CRM): Provides a freemium model, offering a robust free plan with core features, making it attractive to smaller firms. Paid plans, however, are typically priced per user and offer a wider array of features, including marketing automation tools which may or may not be relevant to all bookkeeping businesses. Pricing can range from $Z per user per month to significantly higher depending on the chosen features.

Case Study: Improved Efficiency and Profitability with CRM Implementation

Imagine “Accurate Accounts,” a small bookkeeping firm with three employees. Before implementing CRM D (a hypothetical CRM), they relied on spreadsheets and email, leading to disorganized client data, missed deadlines, and difficulty tracking progress. After adopting CRM D, they saw significant improvements:

- Improved Client Communication: Centralized client information allowed for faster responses and more personalized service, reducing client complaints by 40%.

- Enhanced Workflow Efficiency: Automated tasks such as appointment scheduling and task assignments saved approximately 10 hours per week, freeing up time for higher-value work.

- Increased Revenue: The improved efficiency allowed them to take on 20% more clients within the same timeframe, resulting in a 15% increase in annual revenue.

Return on Investment (ROI) of CRM Systems

The ROI of a CRM varies depending on the size of the bookkeeping firm and the specific CRM chosen. Let’s examine hypothetical scenarios:

- Small Firm (1-2 employees): A small firm might invest in a basic CRM (e.g., a freemium plan or a low-tier subscription) costing $50 per month. If the CRM saves even 5 hours per week in administrative tasks, valued at $X per hour, the ROI could be significant within the first few months.

- Medium Firm (3-10 employees): A medium firm might opt for a mid-tier plan costing $200-$500 per month. The potential ROI here is higher due to increased efficiency gains across multiple employees, potentially leading to a greater increase in billable hours and client acquisition.

- Large Firm (10+ employees): A large firm may invest in a more comprehensive CRM with advanced features, potentially costing several hundred dollars per month per user. The high initial investment is justified by the substantial efficiency gains, improved client management, and potential for significant revenue growth. They might also consider customized CRM solutions, which can be significantly more expensive but provide highly tailored solutions.

CRM Selection Criteria for Bookkeepers

Choosing the right CRM is crucial for bookkeeping businesses to streamline operations, improve client relationships, and ultimately boost profitability. A well-integrated CRM system can automate tasks, centralize client data, and provide valuable insights into business performance. The selection process, however, requires careful consideration of several key factors to ensure a successful implementation.

Selecting a CRM involves evaluating various aspects to find the best fit for your specific needs and budget. It’s not just about finding a system with lots of features; it’s about finding one that seamlessly integrates into your existing workflow and enhances your efficiency. This requires a structured approach, focusing on factors that directly impact your day-to-day operations and long-term growth.

Key Factors to Consider When Choosing a CRM

Bookkeepers should prioritize several key factors when evaluating potential CRM solutions. These factors directly influence the system’s effectiveness and long-term value for the business.

- Scalability: The CRM should be able to handle your current workload and accommodate future growth. Consider the number of clients you anticipate having in the next few years and ensure the CRM can scale accordingly, without significant performance degradation or added costs.

- Ease of Use: A user-friendly interface is essential. The system should be intuitive and easy to learn, minimizing the time spent on training and maximizing productivity. Complex systems can lead to user frustration and ultimately hinder adoption.

- Customer Support: Reliable and responsive customer support is crucial, especially during initial setup and when troubleshooting issues. Look for a vendor that offers multiple support channels (e.g., phone, email, chat) and has a good reputation for helpfulness and responsiveness.

- Security: Data security is paramount in the bookkeeping industry. The CRM should have robust security measures in place to protect sensitive client information, complying with all relevant data privacy regulations (e.g., GDPR, CCPA).

- Integration Capabilities: The CRM should seamlessly integrate with other essential business tools you use, such as accounting software (e.g., Xero, QuickBooks), payroll software, and other applications relevant to your bookkeeping workflow. This eliminates data silos and improves efficiency.

- Reporting and Analytics: The CRM should provide comprehensive reporting and analytics capabilities to track key performance indicators (KPIs), gain insights into client behavior, and make data-driven decisions to improve service and profitability.

Essential Questions to Ask CRM Vendors

Before committing to a CRM purchase, it’s crucial to ask potential vendors specific questions to ensure the software meets your requirements and aligns with your business goals. These questions will help you make an informed decision.

- What are the system’s security features and how do they comply with relevant data privacy regulations?

- What level of customer support is offered, including response times and available channels?

- What are the integration capabilities with other software used in your bookkeeping practice (e.g., specific accounting software)?

- What is the pricing structure, including any hidden fees or additional costs for features or support?

- What is the process for data migration from your existing system, if applicable, and what support is provided during the transition?

- Can you provide case studies or testimonials from other bookkeeping businesses using the CRM?

- What training and onboarding resources are available to users?

CRM User-Friendliness Comparison

User-friendliness is a critical factor in CRM selection. A simple, intuitive interface reduces the learning curve and improves user adoption, leading to increased productivity. This comparison focuses on interface design and ease of learning.

| CRM | Interface Design | Learning Curve | Overall User-Friendliness |

|---|---|---|---|

| CRM A (Example: HubSpot) | Modern, clean, and intuitive design with customizable dashboards. | Relatively easy to learn, with ample online resources and tutorials. | High |

| CRM B (Example: Zoho CRM) | Slightly more complex interface, but highly customizable. | Moderate learning curve, requires some initial effort to master all features. | Medium |

| CRM C (Example: Freshsales) | Simple and straightforward interface, ideal for users with limited technical experience. | Very easy to learn, with a minimal learning curve. | High |

CRM Implementation and Training for Bookkeeping Practices

Successfully implementing a CRM system requires careful planning and execution. A well-structured approach minimizes disruption to daily operations and maximizes the benefits of the new system. This includes a phased rollout, thorough training, and proactive strategies for addressing potential challenges. Ignoring these steps can lead to low adoption rates, data inconsistencies, and ultimately, a failed CRM implementation.

Step-by-Step CRM Implementation Guide

Implementing a CRM in a bookkeeping practice involves a series of well-defined steps. A phased approach allows for controlled deployment and minimizes the risk of overwhelming staff. Each phase should be thoroughly tested before proceeding to the next.

- Needs Assessment and System Selection: Begin by identifying specific bookkeeping needs and challenges that a CRM can address. This involves analyzing current workflows, identifying pain points, and evaluating the features offered by different CRM systems. Consider factors like scalability, integration capabilities, and cost.

- Data Migration Planning: Develop a comprehensive data migration strategy. This includes identifying data sources (e.g., spreadsheets, existing software), cleaning and preparing the data for transfer, and selecting the appropriate migration method (manual, automated, or a hybrid approach). Consider data security and compliance throughout this process. A sample plan might involve exporting data from existing systems in a structured format, verifying data accuracy, and importing it into the new CRM in phases.

- System Configuration and Customization: Configure the chosen CRM to match the bookkeeping practice’s specific needs. This may involve customizing fields, workflows, and reports. Ensure that all necessary integrations with other software (e.g., accounting software) are established and tested.

- Pilot Program and Testing: Conduct a pilot program with a small group of users to test the system’s functionality and identify any issues before full deployment. This allows for iterative improvements and minimizes disruptions during the wider rollout.

- Full System Deployment: Once the pilot program is successful, roll out the CRM to the rest of the bookkeeping team. Provide ongoing support and address any issues that arise promptly.

- Post-Implementation Review: After the full deployment, conduct a review to assess the success of the implementation and identify areas for improvement. This includes gathering feedback from users, monitoring system performance, and making necessary adjustments.

Sample Training Program for Bookkeepers

Effective training is crucial for ensuring user adoption and maximizing the return on investment in a new CRM. The training should be tailored to the specific needs and skill levels of the bookkeepers.

- Introduction to the CRM System: Overview of the system’s purpose, key features, and benefits.

- Navigation and Interface: Learning how to navigate the CRM’s interface, including menus, dashboards, and search functions.

- Contact Management: Adding, editing, and managing client contacts, including contact details, communication history, and notes.

- Task Management: Creating, assigning, and tracking tasks related to client engagements, such as deadlines and follow-ups.

- Reporting and Analytics: Generating reports to track key performance indicators (KPIs), such as client acquisition costs, revenue generated, and project profitability.

- Integration with Other Systems: Understanding how the CRM integrates with other software used by the bookkeeping practice, such as accounting software and email clients.

- Advanced Features: Exploring advanced features such as automation, workflows, and custom reports, depending on the CRM system and the practice’s needs.

- Troubleshooting and Support: Learning how to troubleshoot common issues and access support resources.

Strategies for Overcoming Common Implementation Challenges

Implementing a new CRM system can present several challenges. Proactive planning and communication can mitigate these issues.User resistance is often addressed through clear communication of the benefits of the CRM, involving staff in the selection and implementation process, and providing adequate training and support. Data integration issues can be overcome by careful planning of the data migration process, using appropriate tools and techniques, and ensuring data consistency and accuracy.

Addressing these challenges proactively is key to successful CRM implementation.

Advanced CRM Features for Bookkeeping: Best Crm For Bookkeepers

Modern CRMs offer sophisticated features that significantly boost efficiency and profitability for bookkeeping businesses beyond basic contact management. These advanced capabilities automate tasks, streamline workflows, and improve client communication, ultimately leading to a more streamlined and successful practice.

Automation Capabilities Enhance Efficiency

Automation within a CRM system eliminates repetitive, time-consuming tasks, freeing up bookkeepers to focus on higher-value activities. For instance, automated email reminders for invoice payments can drastically reduce late payments and associated administrative overhead. Workflow automation can also be used to automatically assign tasks to team members based on predefined rules, such as routing tax preparation documents to the appropriate specialist.

Imagine the time saved by automatically generating monthly financial reports and sending them to clients on a pre-set schedule, rather than manually compiling and distributing them. This level of automation significantly increases productivity and reduces the potential for human error.

Workflow Management for Streamlined Processes

Effective workflow management is crucial for handling the complexities of bookkeeping. A CRM can visually map out the entire client onboarding process, from initial contact to final report delivery. This allows for clear identification of bottlenecks and areas for improvement. For example, a visual workflow could highlight delays in receiving client documents, prompting proactive communication and potentially preventing missed deadlines.

This level of organization ensures that every stage of the bookkeeping process runs smoothly and efficiently, reducing errors and improving overall turnaround times. Customizable workflows can be adapted to fit the specific needs of different clients or service packages.

Client Portals for Enhanced Collaboration

Client portals provide a secure online space for clients to access their financial documents, communicate with their bookkeeper, and approve invoices. This eliminates the need for endless email exchanges and significantly improves communication. Clients can upload documents directly, reducing manual data entry for the bookkeeper. The ability for clients to approve invoices online streamlines the billing process, leading to faster payments.

This improved communication and collaboration fosters stronger client relationships and increases client satisfaction.

Improving Client Communication and Collaboration

A CRM system acts as a central hub for all client interactions. It provides a complete history of communications, including emails, phone calls, and notes from meetings. This ensures consistency in communication and prevents important information from being missed. Features like automated email sequences can be used to welcome new clients, provide updates on project progress, or send seasonal greetings.

The ability to schedule appointments directly within the CRM streamlines scheduling and reduces the risk of double-booking. These features improve communication efficiency and build stronger, more productive relationships with clients.

CRM Reporting and Analytics for Business Improvement

CRM reporting and analytics provide valuable insights into the performance of a bookkeeping business. Reports such as revenue by client, time spent on specific tasks, and client acquisition costs offer critical data for strategic decision-making. For example, identifying a client segment with consistently low profitability can inform pricing adjustments or resource allocation. Analyzing the time spent on different tasks can reveal areas where process improvements can increase efficiency.

Tracking key performance indicators (KPIs) like client retention rates and revenue growth helps measure the overall success of the business and identify areas needing attention. Customizable dashboards allow for easy monitoring of critical metrics, providing a clear picture of the business’s health and performance. Specific reports like “Revenue by Service Type” or “Client Churn Rate” can highlight areas needing immediate attention or strategic planning.

Last Point

Selecting the best CRM for your bookkeeping practice is a crucial step towards enhancing efficiency and client satisfaction. By carefully considering the factors Artikeld in this guide—from essential features and pricing to implementation and training—you can confidently choose a system that aligns with your business needs and budget. Remember to prioritize ease of use, robust integration capabilities, and strong customer support to maximize your return on investment and unlock the full potential of your bookkeeping business.

FAQ Guide

What is the average cost of a CRM for bookkeepers?

Costs vary greatly depending on features, users, and vendor. Expect to pay anywhere from a few dollars per month for basic plans to hundreds for enterprise solutions.

How long does it typically take to implement a new CRM?

Implementation time depends on the CRM’s complexity and your business size. Allow several weeks to months for setup, data migration, and staff training.

Can I integrate my CRM with my existing accounting software?

Many CRMs offer integrations with popular accounting software like QuickBooks and Xero. Check the CRM’s compatibility before purchasing.

What kind of training is available for bookkeepers using a new CRM?

Most vendors provide online tutorials, webinars, and sometimes on-site training. Look for vendors with comprehensive training resources.