Best CRM for accounting firms is a critical decision impacting efficiency and client satisfaction. Finding the right system requires careful consideration of firm size, specific needs, and budget. This exploration delves into the key features, popular options, and implementation strategies to help accounting firms select the ideal CRM solution for streamlined operations and enhanced profitability.

This guide navigates the complexities of choosing a CRM, from defining your firm’s unique requirements to understanding the long-term cost implications and future trends shaping the industry. We’ll compare leading CRM platforms, analyze crucial features like contact management, project management, and reporting, and offer insights into successful implementation strategies.

Defining Needs of Accounting Firms

Accounting firms, regardless of size, face unique challenges in managing client relationships and streamlining operations. A robust CRM system can significantly alleviate these pressures, leading to improved efficiency and client satisfaction. Understanding the specific needs of accounting firms is crucial for selecting the right CRM solution.

Effective client management is paramount for accounting firms. Losing track of deadlines, miscommunication, and inefficient workflows can lead to errors, missed opportunities, and ultimately, dissatisfied clients. A well-implemented CRM system addresses these issues directly, centralizing client information and automating key processes.

Top Five Challenges Faced by Accounting Firms Regarding Client Management

The following five challenges consistently impact the operational efficiency and client satisfaction of accounting firms. Addressing these challenges through CRM implementation leads to a more streamlined and profitable practice.

- Client Onboarding and Communication: Inefficient onboarding processes and inconsistent communication can lead to delays and frustration for both clients and the firm.

- Tracking Deadlines and Tasks: Managing multiple clients and deadlines simultaneously requires a robust system to prevent missed deadlines and ensure timely service delivery.

- Data Management and Organization: Scattered client information across multiple platforms leads to inefficiencies and potential errors. Centralized data management is critical.

- Collaboration and Team Workflow: Effective collaboration among team members is crucial for efficient task management and consistent client service. Poor internal communication can lead to delays and errors.

- Client Relationship Maintenance: Building and maintaining strong client relationships requires consistent engagement and proactive communication. A CRM helps track interactions and identify opportunities for further engagement.

Key CRM Features to Address Accounting Firm Challenges

To effectively address the challenges Artikeld above, a CRM for accounting firms needs specific features. These features should integrate seamlessly to create a comprehensive solution.

- Centralized Client Database: A single source of truth for all client information, including contact details, financial data, communication history, and task assignments.

- Automated Workflow and Task Management: Automated reminders, task assignments, and progress tracking to ensure timely completion of tasks and deadlines.

- Document Management: Secure storage and easy access to all client-related documents, including tax returns, financial statements, and contracts.

- Communication Tools: Integrated communication features, such as email, phone, and messaging, to streamline client interaction and maintain a consistent communication channel.

- Reporting and Analytics: Comprehensive reporting and analytics capabilities to track key performance indicators (KPIs), identify trends, and make data-driven decisions.

Importance of Integration with Accounting Software

Seamless integration with existing accounting software is crucial for a CRM in the accounting context. This integration avoids data duplication and ensures a consistent flow of information between systems. It streamlines workflows and reduces manual data entry, improving efficiency and accuracy.

For example, a CRM integrated with accounting software can automatically update client balances, track invoices, and generate reports based on financial data. This eliminates the need for manual data transfer and reduces the risk of errors. The time saved can be redirected towards more strategic activities, like client relationship building and business development.

CRM Functionality Needs Based on Firm Size

The specific CRM functionality requirements vary depending on the size of the accounting firm. Small firms may prioritize ease of use and affordability, while larger firms might require more advanced features and scalability.

| Feature | Small Firm (<10 Employees) | Medium Firm (10-50 Employees) | Large Firm (>50 Employees) |

|---|---|---|---|

| Client Database | Basic contact information, simple task management | Comprehensive client profiles, advanced task management, custom fields | Highly customized client profiles, advanced workflow automation, integration with multiple systems |

| Reporting & Analytics | Basic reporting on client activity | Customizable reports, KPI tracking | Advanced analytics dashboards, predictive modeling, real-time data visualization |

| Integration | Integration with primary accounting software | Integration with multiple accounting and other business applications | Extensive API access for custom integrations and data exchange |

| Scalability | Limited scalability needs | Moderate scalability required | High scalability and flexibility to accommodate growth |

CRM Features for Accounting Firms: Best Crm For Accounting Firms

Choosing the right CRM can significantly impact an accounting firm’s efficiency and profitability. A well-integrated system streamlines workflows, improves client communication, and provides valuable insights into business performance. The key lies in selecting a CRM with features specifically designed to meet the unique needs of the accounting profession.

Contact Management

Effective contact management is paramount for accounting firms. A CRM system should provide a centralized repository for all client and contact information, including detailed financial data, communication history, and relevant documents. This eliminates the need for disparate spreadsheets and ensures everyone in the firm has access to the most up-to-date information. This improved accessibility reduces errors, speeds up response times to client queries, and facilitates better collaboration among team members.

For example, a CRM can track communication history, including emails, phone calls, and notes from meetings, offering a complete picture of client interactions and ensuring consistent service delivery.

Project Management Capabilities

Project management features within a CRM allow accounting firms to efficiently track the progress of various client engagements. These features typically include task assignment, deadline setting, progress monitoring, and the ability to share documents securely within the platform. This enhances team collaboration and ensures that projects stay on schedule and within budget. Consider a scenario where an auditor is managing multiple tax audits simultaneously.

The CRM’s project management tools can help assign tasks to team members, track deadlines for each audit stage (e.g., data collection, analysis, report writing), and provide a clear overview of the project’s overall status, preventing delays and ensuring timely completion.

Reporting and Analytics

Robust reporting and analytics capabilities are crucial for data-driven decision-making within an accounting firm. The ideal CRM should offer customizable reports that provide insights into key performance indicators (KPIs), such as client acquisition costs, revenue generated per client, and the average time spent on specific tasks. These reports allow firms to identify areas for improvement, optimize workflows, and ultimately increase profitability.

For instance, a CRM could generate a report showing the revenue generated by different client segments, allowing the firm to focus marketing efforts on the most profitable groups. Further, dashboards displaying real-time data on key metrics provide immediate visibility into the firm’s performance.

Automation of Routine Tasks

Automating routine tasks significantly boosts efficiency and frees up staff for higher-value activities. A CRM can automate tasks such as client onboarding, appointment scheduling, and sending out recurring invoices. Workflow automation features allow firms to create custom workflows for common processes, reducing manual data entry and minimizing the risk of errors. For example, when a new client signs up, the CRM can automatically send a welcome email, schedule an initial consultation, and create a new project file in the system.

This automated process ensures a smooth and efficient onboarding experience for both the firm and the client, saving valuable time and resources.

Popular CRM Options

Choosing the right CRM is crucial for accounting firms of all sizes. The ideal platform will streamline workflows, improve client communication, and ultimately boost efficiency and profitability. This section compares three leading CRM options, highlighting their strengths and weaknesses to aid in your selection process.

Comparison of Three Leading CRM Platforms

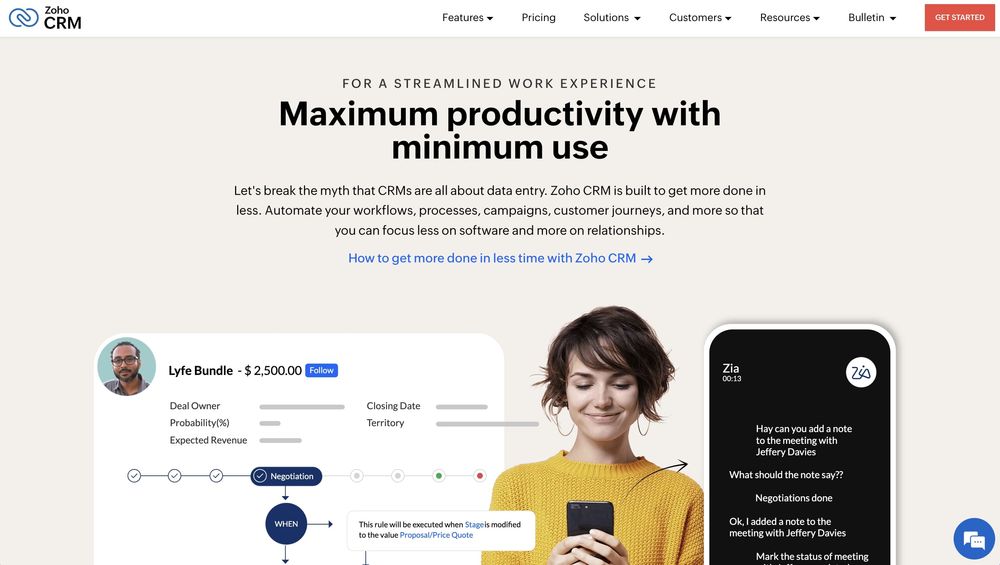

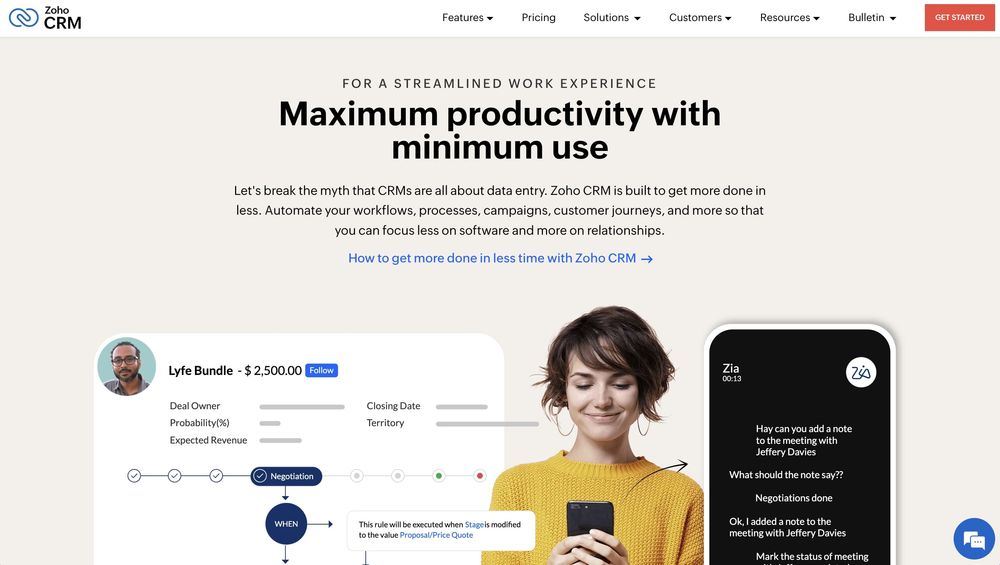

Several CRM platforms cater specifically to the needs of accounting firms. Below, we compare three popular choices: Xero, QuickBooks Online (with its CRM features), and Zoho CRM. Each offers a unique set of features and benefits.

| Feature | Xero | QuickBooks Online | Zoho CRM |

|---|---|---|---|

| Core Functionality | Accounting software with integrated CRM features; strong focus on financial management and client invoicing. | Accounting software with integrated CRM features; similar focus to Xero, but with potentially broader integrations. | Dedicated CRM platform with robust contact management, sales pipeline tracking, and reporting features; requires separate accounting software integration. |

| Client Management | Centralized client database, linked directly to financial data. | Centralized client database, similarly linked to financial data. | Comprehensive contact management tools, including custom fields and detailed interaction tracking. |

| Reporting & Analytics | Provides financial reports and key performance indicators (KPIs) related to client activity and profitability. | Similar reporting capabilities to Xero, often with more customization options. | Detailed reporting and analytics dashboards, customizable to track various sales and client engagement metrics. |

| Integrations | Integrates well with other Xero ecosystem apps; potentially limited integrations outside this ecosystem. | Broader range of integrations compared to Xero, supporting various third-party applications. | Extensive API and a large marketplace of integrations, enabling connection with many accounting and other business applications. |

Feature Comparison Chart

This table provides a more concise comparison of pricing, scalability, and integration capabilities across the three CRMs. Pricing models can vary based on the number of users and features selected.

| Feature | Xero | QuickBooks Online | Zoho CRM |

|---|---|---|---|

| Pricing | Tiered pricing based on features and number of users; generally affordable for smaller firms. | Tiered pricing similar to Xero; pricing can vary depending on the selected plan and add-ons. | Highly tiered pricing, with options for various user numbers and features; can become expensive for larger firms with extensive needs. |

| Scalability | Scales well for growing firms, with options to add users and features as needed. | Similar scalability to Xero, offering flexibility for expanding businesses. | Highly scalable, suitable for both small and large accounting firms; can handle significant data volumes and user counts. |

| Integrations | Strong integration within the Xero ecosystem, but potentially limited external integrations. | Extensive integration capabilities, supporting a wide range of third-party applications. | Very extensive integration capabilities via API and marketplace, offering great flexibility. |

Cloud-Based vs. On-Premise CRM: Pros and Cons

The decision between cloud-based and on-premise CRM solutions significantly impacts cost, accessibility, and maintenance.

Here’s a breakdown of the advantages and disadvantages of each approach for accounting firms:

- Cloud-Based CRM: Pros

- Accessibility: Access data from anywhere with an internet connection.

- Cost-effectiveness: Lower upfront costs and reduced IT infrastructure needs.

- Automatic updates: Always running the latest version of the software.

- Scalability: Easily adjust user numbers and storage as needed.

- Cloud-Based CRM: Cons

- Internet dependency: Requires a reliable internet connection.

- Security concerns: Reliance on third-party security measures.

- Vendor lock-in: Potential difficulty switching providers.

- On-Premise CRM: Pros

- Greater control: Complete control over data and security.

- No internet dependency: Operates independently of internet connectivity.

- Customization: Potentially greater flexibility in customizing the system.

- On-Premise CRM: Cons

- High upfront costs: Significant investment in hardware and software.

- Ongoing maintenance: Requires dedicated IT staff for maintenance and updates.

- Limited accessibility: Access is restricted to the firm’s physical location.

CRM System Support for Different Firm Sizes and Service Offerings, Best crm for accounting firms

The choice of CRM should align with the accounting firm’s size, service offerings, and future growth plans.

For example:

- Small firms (1-5 employees) might find Xero or QuickBooks Online sufficient, leveraging their integrated features and affordability.

- Medium-sized firms (6-20 employees) could benefit from Zoho CRM’s scalability and broader integration capabilities, allowing for customization as their needs evolve.

- Large firms (20+ employees) with complex service offerings might require a more robust, potentially custom-built, solution to manage client data, projects, and workflows efficiently.

Implementation and Training

Successfully implementing a new CRM system requires careful planning and execution. A phased approach, coupled with robust training, is crucial for maximizing user adoption and realizing the full benefits of the investment. Ignoring these aspects can lead to low user engagement, inaccurate data, and ultimately, a failed CRM implementation.Implementing a new CRM system within an accounting firm involves several key steps, each demanding careful consideration and execution.

A poorly planned implementation can lead to wasted resources and user frustration.

CRM System Implementation Steps

The implementation process typically unfolds in several phases. First, a thorough needs assessment is conducted to determine the specific requirements of the firm. This includes identifying key functionalities, data points, and user roles. Next, the chosen CRM system is configured to meet these needs. This involves customizing workflows, fields, and reporting capabilities.

Data migration from existing systems is a critical step, requiring careful planning and execution to ensure data integrity. User training follows, equipping employees with the skills and knowledge to effectively utilize the new system. Finally, a go-live phase is implemented, followed by ongoing monitoring and support to address any issues and optimize system performance. This iterative process ensures a smooth transition and optimal system utilization.

Importance of Comprehensive Employee Training Programs

Comprehensive employee training is paramount for successful CRM adoption. Without proper training, employees may struggle to use the system effectively, leading to data inaccuracies and low user adoption. Effective training programs should be tailored to different user roles and skill levels, incorporating hands-on exercises and real-world scenarios. Ongoing support and refresher training should also be provided to address any questions or challenges that arise.

For example, a training program could include modules on data entry, report generation, and contact management, customized for the specific roles within the accounting firm (e.g., tax preparers, auditors, client managers). This ensures that each employee receives training relevant to their tasks and responsibilities.

Data Migration Best Practices

Data migration is a critical step in CRM implementation, requiring meticulous planning and execution to maintain data integrity. A well-defined data migration plan should include data cleansing, transformation, and validation steps to ensure accuracy and consistency. This involves identifying and correcting errors, transforming data into a format compatible with the new CRM system, and validating the migrated data to ensure its accuracy.

For example, before migrating client data, the firm should cleanse the data by removing duplicates, correcting inconsistencies, and verifying the accuracy of contact information. This process should be documented thoroughly, and regular backups should be performed to prevent data loss. Consider using a phased approach to data migration, migrating smaller subsets of data initially to test the process and identify any issues before migrating the entire dataset.

Strategies for Overcoming Resistance to Change

Resistance to change is a common challenge during CRM adoption. To overcome this, it is crucial to actively engage employees throughout the implementation process. This includes involving employees in the selection and configuration of the CRM system, providing clear communication about the benefits of the new system, and addressing their concerns and anxieties. Furthermore, providing adequate training and support, and recognizing and rewarding early adopters, can help foster a positive attitude towards the new system.

For example, organizing regular feedback sessions allows employees to express concerns and suggest improvements. Highlighting success stories and demonstrating how the CRM system can improve efficiency and productivity can also motivate employees to embrace the change. Open communication and proactive engagement are key to overcoming resistance and ensuring a smooth transition.

Cost and ROI Considerations

Implementing a CRM system involves more than just the initial software purchase. A comprehensive understanding of the associated costs and the potential return on investment is crucial for accounting firms to make informed decisions. This section details the various cost components and provides a framework for assessing the financial viability of CRM adoption.

Cost Components of CRM Implementation and Maintenance

The total cost of ownership (TCO) for a CRM system extends beyond the initial license fee. Several factors contribute to the overall expense. These include the software license itself (which may be a one-time purchase or a recurring subscription), implementation costs (consultant fees, data migration, customization), training costs for staff, ongoing maintenance fees (updates, technical support), and potential integration costs with existing accounting software.

Hidden costs such as lost productivity during implementation should also be considered. For example, a mid-sized firm might spend $5,000 on the software license, $10,000 on implementation, $2,000 on training, and $1,000 annually on maintenance. These figures are estimates and will vary greatly based on the chosen CRM, firm size, and complexity of implementation.

Calculating Return on Investment (ROI) for a CRM System

Calculating the ROI for a CRM system requires a careful assessment of both costs and benefits. The formula for ROI is:

ROI = (Net Benefits – Total Costs) / Total Costs

Net benefits include improvements in efficiency (reduced administrative time, faster client onboarding), increased revenue (through improved client relationships and upselling opportunities), and cost savings (reduced errors, improved resource allocation). To calculate the ROI, an accounting firm needs to quantify these benefits in monetary terms. For instance, if a CRM system reduces administrative time by 10 hours per week per employee, and the average employee cost is $50/hour, the annual benefit per employee would be $26,000 ($50/hour

- 10 hours/week

- 52 weeks/year). Subtracting the total costs from the total benefits, and dividing by the total costs will yield the ROI.

Hypothetical Cost-Benefit Analysis

Let’s consider a hypothetical cost-benefit analysis for implementing “AcmeCRM” in a firm with 10 employees.

| Item | Cost | Benefit | Benefit Type |

|---|---|---|---|

| Software License (Annual) | $6,000 | ||

| Implementation | $12,000 | ||

| Training | $2,000 | ||

| Annual Maintenance | $1,000 | ||

| Increased Efficiency (10 hours/week/employee) | $260,000 | Reduced labor costs | |

| Improved Client Retention (5% increase) | $50,000 | Increased revenue | |

| Reduced Errors (1% reduction in billing errors) | $10,000 | Cost savings |

Total Costs: $21,000; Total Benefits: $320,000; ROI: (320,000 – 21,000) / 21,000 = 14.29 or 1429%

Factors Impacting Long-Term Cost-Effectiveness

Several factors influence the long-term cost-effectiveness of different CRM systems.

- Scalability: The ability of the CRM to adapt to the firm’s growth without requiring significant additional investment.

- Integration Capabilities: Seamless integration with existing accounting software and other business tools minimizes disruptions and reduces integration costs.

- Customization Options: The flexibility to tailor the CRM to the firm’s specific needs reduces the need for expensive custom development.

- Support and Maintenance Costs: Ongoing support and maintenance costs should be factored into the long-term budget.

- User Adoption Rate: High user adoption ensures that the investment in the CRM yields the expected benefits.

Future Trends in Accounting Firm CRMs

The accounting industry is undergoing a rapid digital transformation, and Customer Relationship Management (CRM) systems are at the forefront of this change. Over the next five years, several key trends will significantly shape the CRM landscape for accounting firms, impacting how they manage client relationships, streamline workflows, and enhance operational efficiency. Understanding these trends is crucial for firms aiming to remain competitive and provide superior client service.The integration of advanced technologies and the increasing emphasis on data security will redefine the capabilities and requirements of accounting firm CRMs.

Artificial Intelligence in Accounting Firm CRMs

AI is poised to revolutionize CRM functionality for accounting firms. AI-powered features, such as predictive analytics, can anticipate client needs and proactively offer relevant services. For example, a CRM could analyze client transaction history to identify potential tax deductions or suggest financial planning strategies. Natural language processing (NLP) can automate tasks like summarizing client communications or generating reports.

Machine learning algorithms can improve lead scoring and client segmentation, allowing firms to target marketing efforts more effectively. This level of automation frees up staff time for higher-value activities, such as client relationship building and strategic advisory services. Consider a scenario where an AI-powered CRM flags a client nearing a tax deadline, automatically generating a reminder email and pre-filling relevant documents based on previous years’ data.

This proactive approach improves client service and minimizes the risk of missed deadlines.

Data Security and Privacy in Accounting Firm CRMs

Data security and privacy are paramount for accounting firms, given the sensitive financial information they handle. Future CRM systems will need to incorporate robust security measures, such as multi-factor authentication, encryption, and regular security audits. Compliance with regulations like GDPR and CCPA will be crucial. Furthermore, CRMs must offer granular control over data access and permissions, ensuring that only authorized personnel can view sensitive client information.

The increasing use of cloud-based CRMs necessitates a thorough understanding of data residency and compliance requirements. A breach of client data could have severe legal and reputational consequences, highlighting the critical importance of prioritizing data security features when selecting a CRM.

The Rise of Integrated Platforms

Accounting firms are increasingly adopting integrated platforms that combine CRM functionality with other essential business tools, such as accounting software, project management systems, and document management systems. This integration streamlines workflows, eliminates data silos, and provides a holistic view of client interactions and financial data. For instance, a seamless integration between a CRM and accounting software could automatically update client contact information and financial details, ensuring data consistency and minimizing manual data entry.

This trend simplifies data management and enhances operational efficiency, leading to improved productivity and reduced errors. The selection of a CRM should therefore prioritize seamless integration with existing accounting and other business software.

Epilogue

Selecting the best CRM for your accounting firm is a journey that requires careful planning and execution. By understanding your firm’s specific needs, evaluating various platforms, and implementing a well-structured training program, you can unlock the potential of a CRM to improve efficiency, enhance client relationships, and ultimately, drive growth. The right CRM is not just a software; it’s a strategic investment in your firm’s future success.

FAQ

What is the average cost of a CRM for accounting firms?

Costs vary greatly depending on the chosen platform, features, number of users, and level of customization. Expect a range from a few hundred dollars per month for basic plans to several thousand for enterprise-level solutions.

How long does it typically take to implement a new CRM system?

Implementation timeframes vary, but a realistic estimate is several weeks to a few months, depending on the complexity of the system, data migration needs, and employee training requirements.

What are the key indicators of a successful CRM implementation?

Successful implementation is measured by increased efficiency, improved client satisfaction, better data management, and a demonstrable return on investment (ROI). Tracking these metrics helps gauge the effectiveness of the CRM system.